Bitcoin white paper explained in spanish

The bitcoin network is a peer-to-peer payment network that operates on a cryptographic protocol. Users send and receive bitcoinsthe units of currency, by broadcasting digitally signed messages to the network using bitcoin cryptocurrency wallet software. Transactions are recorded into a distributed, replicated public database known as the blockchainwith consensus achieved by a proof-of-work system called mining. Satoshi Nakamotothe designer of bitcoin claimed that design and coding of bitcoin begun in The network requires minimal structure to share transactions.

An ad hoc decentralized network of volunteers is sufficient. Messages are broadcast on a best effort basis, and nodes can leave and rejoin the network at will. Upon reconnection, a node downloads and verifies new blocks from other nodes to complete its local copy of the blockchain. A bitcoin is defined by a sequence of digitally signed transactions that began with the bitcoin's creation, as a block reward.

The owner of a bitcoin transfers it by digitally signing it over to the next owner using a bitcoin transaction, much like endorsing a traditional bank check. A payee can bitcoin white paper explained in spanish each previous transaction to verify the chain of ownership. Unlike traditional check endorsements, bitcoin transactions are irreversible, which eliminates risk of chargeback fraud.

Although it is possible to handle bitcoins individually, it would be unwieldy to require a separate transaction for every bitcoin in a transaction. Common transactions will have either a single input from a larger previous transaction or multiple inputs combining smaller amounts, and one or two outputs: Any difference between the total input and output amounts of a transaction goes to miners as a transaction fee.

To form a distributed timestamp server as a peer-to-peer network, bitcoin uses a proof-of-work system. The signature is discovered rather than provided by knowledge. Requiring a proof of work to provide the signature for the blockchain was Satoshi Nakamoto's key bitcoin white paper explained in spanish.

While the average work required increases in inverse proportion to the difficulty target, a hash can always be verified by executing a single round of double SHA For the bitcoin timestamp network, a valid proof of work is found by incrementing a nonce until a value is found that gives the block's hash the required number of leading zero bits.

Once the hashing has produced a valid result, the block cannot be changed without redoing the work. As later blocks are chained after it, the work to change the block would include redoing the work for each subsequent block. Majority consensus in bitcoin is represented by the longest chain, which required the greatest amount of effort to produce.

If a bitcoin white paper explained in spanish of computing power is controlled by honest nodes, bitcoin white paper explained in spanish honest chain will grow fastest and outpace any competing chains. To modify a past block, an attacker would have to redo bitcoin white paper explained in spanish proof-of-work of that block and all blocks after it and then surpass the work of the honest nodes. The probability of a slower attacker catching up diminishes exponentially as subsequent blocks are added.

To compensate for increasing hardware speed and varying interest in bitcoin white paper explained in spanish nodes over time, the difficulty of finding a valid hash is adjusted roughly every two weeks. If blocks are generated too quickly, the difficulty increases and more hashes are required to make a block and to generate new bitcoins.

Bitcoin mining is a competitive endeavor. An " arms race " has been observed through the various hashing technologies that have been used to mine bitcoins: Computing power is often bundled bitcoin white paper explained in spanish or "pooled" to reduce variance in miner income.

Individual mining rigs often have to wait for long periods to confirm a block of transactions and receive payment. In a pool, all participating miners get paid every time a participating server solves a block. This payment depends on the amount of work an individual miner contributed to help find that block. Bitcoin data centers prefer to keep a low profile, are dispersed around the world and tend to cluster around the availability of cheap electricity. InMark Gimein estimated electricity consumption to be about To lower bitcoin white paper explained in spanish costs, bitcoin miners have set up in places like Iceland where geothermal energy is cheap and cooling Arctic air is free.

A rough overview of the process to mine bitcoins is: By convention, the first transaction in a block is a special transaction that produces new bitcoins owned by the creator of the block.

This is the incentive for nodes to support the network. The reward for bitcoin white paper explained in spanish halves everyblocks. It started at 50 bitcoin, dropped to 25 in late and to Various potential attacks on the bitcoin network and its use as a payment system, real or theoretical, have been considered.

The bitcoin protocol includes several features that protect it against some of those attacks, such as unauthorized spending, double spending, forging bitcoins, and tampering bitcoin white paper explained in spanish the blockchain.

Other attacks, such as theft of private keys, require due care by users. Unauthorized spending is mitigated by bitcoin's implementation of public-private key cryptography. For example; when Alice sends a bitcoin to Bitcoin white paper explained in spanish, Bob becomes the new owner of the bitcoin.

Eve observing the transaction might bitcoin white paper explained in spanish to spend the bitcoin Bob just received, but she cannot sign the transaction without the knowledge of Bob's private key. A bitcoin white paper explained in spanish problem that an internet payment system must solve bitcoin white paper explained in spanish double-spendingwhereby a user pays the same coin to two or more different recipients.

An example of such a problem would be if Eve sent a bitcoin to Alice and later sent the same bitcoin to Bob. The bitcoin white paper explained in spanish network guards against double-spending by recording all bitcoin transfers in a ledger the blockchain that is visible to all users, and ensuring for all transferred bitcoins that they haven't been previously spent. If Eve offers to pay Alice a bitcoin in exchange for goods and signs a corresponding transaction, it is still possible that she also creates a different transaction at the same time sending the same bitcoin to Bob.

By the rules, the network accepts only one of the transactions. This is called a race attacksince there is a race which transaction will be accepted first. Alice can reduce the risk of race attack stipulating that she will not deliver the goods until Eve's payment to Alice appears in the blockchain. A variant race attack which has been called a Finney attack by reference to Hal Finney requires the participation of a miner.

Instead of bitcoin white paper explained in spanish both payment requests to pay Bob and Alice with the same coins to the network, Eve issues only Alice's payment request to the network, while the accomplice tries to mine a block that includes the payment to Bob instead of Alice.

There is a positive probability that the rogue miner will succeed before the network, in which case the payment to Alice will be rejected. As with the plain race attack, Alice can reduce the risk of a Finney attack by waiting for the payment to be included in the blockchain. Each block that is added to the blockchain, starting with the block containing a given transaction, is called a confirmation of that transaction.

Ideally, merchants and services that receive payment in bitcoin should wait for at least one confirmation to be distributed over the network, before assuming that the payment was done. Deanonymisation is a strategy in data mining in which anonymous data is cross-referenced with other sources of data to re-identify the anonymous data source.

Along with transaction graph analysis, which may reveal connections between bitcoin addresses pseudonyms[20] [25] there is a possible attack [26] which links a user's pseudonym to its IP address. If the peer is using Torthe attack includes a method to separate the peer from the Tor network, forcing them to use their real IP address for any further transactions.

The attack makes use of bitcoin mechanisms of relaying peer addresses and anti- DoS protection. Each miner can choose which transactions are included in or exempted from a block. Upon receiving a new transaction a node must validate it: To carry out that check the node needs to access the blockchain. Any user who does not trust his network neighbors, should keep a full local copy of the blockchain, so that any input can be verified.

As noted in Nakamoto's whitepaper, it is possible to verify bitcoin payments without running a full network node simplified payment verification, SPV.

A user only needs a copy of the block headers of the longest chain, which are available by querying network nodes until it is apparent that the longest chain has been obtained. Then, get the Merkle branch linking the transaction to its block. Linking the transaction to a place in the chain demonstrates that a network node has accepted it, and blocks added after it further establish the confirmation.

While it is possible to store any digital file in the blockchain, the larger the transaction size, the larger any associated fees become. The use of bitcoin by criminals has attracted the attention of financial regulators, legislative bodies, law enforcement, and the media. Senate held a hearing on virtual currencies in November Several news outlets have asserted that the popularity of bitcoins hinges on the ability to use them to purchase illegal goods.

A CMU researcher estimated that in4. Due to the anonymous nature and the lack of central control on these markets, it is hard to know whether the services are real or just trying to take the bitcoins. Bitcoin white paper explained in spanish deep web black markets have been shut by authorities. In October Silk Road was shut down by U. Some black market sites may seek to steal bitcoins from customers. The bitcoin community branded one site, Sheep Marketplace, as a scam when it prevented withdrawals and shut down after an alleged bitcoins theft.

According to the Internet Watch Foundationa UK-based charity, bitcoin is used to purchase child pornography, and almost such websites accept it as payment. Bitcoin isn't the sole way to purchase child pornography online, as Troels Oertling, head of the cybercrime unit at Europolstates, "Ukash and Paysafecard Bitcoins may not be ideal for money laundering, because all transactions are public.

In earlyan operator of a U. Securities and Exchange Commission charged the company and its founder in "with defrauding investors in a Ponzi scheme involving bitcoin". From Wikipedia, the free encyclopedia. For a broader coverage related to this topic, see Bitcoin. Information technology portal Cryptography portal. Archived from the original on 3 November Retrieved 2 November Retrieved 30 January Retrieved 20 December Financial Cryptography and Data Security.

Retrieved 21 August Retrieved 3 October Retrieved 9 January

A blockchain[1] [2] [3] originally block chain[4] [5] is a continuously growing list of recordscalled blockswhich are linked and secured using cryptography. It is "an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way". Once recorded, the data in any given block cannot be altered retroactively without the alteration of all subsequent blocks, which requires collusion of the network majority.

Blockchains are secure by design and exemplify a distributed computing system with high Byzantine fault tolerance. Decentralized consensus has therefore been achieved with a blockchain.

Blockchain was invented by Satoshi Nakamoto in bitcoin white paper explained in spanish use in the cryptocurrency bitcoinas its public transaction ledger. The bitcoin design has been the inspiration for other applications. The first work on a cryptographically secured chain of blocks was described in by Stuart Haber and W. InBayer, Haber and Stornetta incorporated Merkle trees to the design, which improved its efficiency by allowing several documents to be collected into one block.

The first blockchain was conceptualized by a person or group of people known as Satoshi Nakamoto in It was implemented the following year by Nakamoto as a core component of the cryptocurrency bitcoin, where it serves as the public ledger for all transactions bitcoin white paper explained in spanish the network.

The words block and chain were used separately in Satoshi Nakamoto's original paper, but were eventually popularized as a single word, blockchain, by The term blockchain 2. Second-generation blockchain technology makes it possible to store an individual's "persistent digital ID and persona" and provides an avenue to help solve the problem of social inequality by "potentially changing the way wealth is distributed". Inthe central securities depository of the Russian Federation NSD announced a pilot project, based on the Nxt blockchain 2.

A blockchain is a decentralized, distributed and public digital ledger that is used to record transactions across many computers so that the record cannot be altered retroactively without the alteration of all subsequent blocks and the collusion of the network. They are authenticated by bitcoin white paper explained in spanish collaboration powered by collective self-interests. The use of a blockchain removes the characteristic of bitcoin white paper explained in spanish reproducibility from a digital asset.

It confirms that each unit of value was transferred only once, solving the long-standing problem of double spending. Blockchains have been bitcoin white paper explained in spanish as a value -exchange protocol.

Blocks hold batches of valid transactions that are hashed and encoded into a Merkle tree. The linked blocks form a chain. Sometimes separate blocks can be produced concurrently, creating a temporary fork. In addition to a secure bitcoin white paper explained in spanish history, any blockchain has a specified algorithm for scoring different bitcoin white paper explained in spanish of the history so that one with a higher value can be selected over others.

Blocks not selected for inclusion in the chain are called orphan blocks. They keep only the highest-scoring version of the database known to them. Whenever a peer receives a higher-scoring version usually the old version with a single new block added they extend or overwrite their own database and retransmit the improvement to their peers. There is never an absolute guarantee that any particular entry will remain in the best version of the history forever.

Because blockchains are typically built to add the score of new blocks onto old blocks and because there are incentives to work only on extending with new blocks rather than overwriting old blocks, the probability of an entry becoming superseded goes down exponentially [36] as more blocks are built on top of it, eventually becoming very low.

There are a number of methods that can be used to demonstrate a sufficient level of computation. Within a blockchain the computation is carried out redundantly rather than in the traditional segregated and parallel manner. The block time is the average time it takes for the network to generate one extra block in the blockchain.

In cryptocurrency, this bitcoin white paper explained in spanish practically when the money transaction takes place, so a shorter block time means faster transactions. The block time for Ethereum is set to between 14 and 15 seconds, while for bitcoin it is 10 minutes. A hard fork is a rule change such that the software validating according to the old rules will see the blocks produced according to the new rules as invalid.

In case of a hard fork, all nodes meant to work in accordance with the new rules need to upgrade their software. If one group of nodes continues to use the old software while bitcoin white paper explained in spanish other nodes use the new software, a split can occur.

For example, Ethereum has hard-forked to "make whole" the investors in The DAOwhich had been hacked by exploiting a vulnerability in its code. Bitcoin white paper explained in spanish the Nxt community was asked to consider a hard fork that would have led to a rollback of the blockchain records to mitigate the effects of a theft of 50 million NXT from a bitcoin white paper explained in spanish cryptocurrency exchange. The hard fork proposal was rejected, and some of the funds were recovered after negotiations and ransom payment.

Alternatively, to prevent a permanent split, a majority of nodes using the new software may return to the old rules, as was the case of bitcoin split on 12 March By storing data across its peer-to-peer network, the blockchain eliminates a bitcoin white paper explained in spanish of risks that come with data being held centrally.

Peer-to-peer blockchain networks lack centralized points of vulnerability that computer crackers can exploit; likewise, it has no central point of failure. Blockchain security methods include the use of public-key cryptography. Value tokens sent across the network are recorded as belonging to that address.

A private key is like a password that gives its owner access to their digital assets or the means to otherwise interact with the various capabilities that blockchains now support. Data stored on the blockchain is generally bitcoin white paper explained in spanish incorruptible. While centralized data is more easily controlled, information and data manipulation are possible.

By decentralizing data on an accessible ledger, public blockchains make block-level data transparent to everyone involved. Every node in a decentralized system has a copy of the blockchain.

Data quality is maintained by massive database replication [9] and computational trust. No centralized "official" copy exists and no user is "trusted" more than any other. Messages are delivered on a best-effort basis. Mining nodes validate transactions, [35] add them to the block they are building, and then broadcast the completed block to other nodes.

Open blockchains are more user-friendly than some traditional ownership records, which, while open to the public, still require physical access to view. Because all early blockchains were permissionless, controversy has arisen over the blockchain definition. An issue in this ongoing debate is whether a private system with verifiers tasked and authorized permissioned by a central authority should be considered a blockchain. These blockchains serve as a distributed version of multiversion concurrency control MVCC in databases.

The great advantage to an open, permissionless, or public, blockchain network is that guarding against bad actors is not required and no access control is needed. Bitcoin and other cryptocurrencies currently secure their blockchain by requiring new entries to include a proof of work.

To prolong the blockchain, bitcoin uses Hashcash puzzles. Financial companies have not prioritised decentralized blockchains. Permissioned blockchains use an access control layer to govern who has access to the network. They do not rely on anonymous nodes to validate transactions nor do they benefit from the network effect.

The New York Times noted in both and that many corporations are using blockchain networks "with private blockchains, independent of the public system. Nikolai Hampton pointed out in Computerworld that "There is also no need for a '51 percent' attack on a private blockchain, as the private blockchain most likely already controls percent of all block creation resources.

If you could attack or damage the blockchain creation tools on a private corporate server, you could effectively control percent of their network and alter transactions however you wished. It's unlikely that any private blockchain will try to protect records using gigawatts of computing power—it's time consuming and expensive.

This means that many in-house blockchain solutions will be nothing more than cumbersome databases. Data interchange between participants in a blockchain is a technical challenge that could inhibit blockchain's adoption and use. This has not yet become an issue because thus far participants in a blockchain have agreed either tacitly or actively on metadata standards.

Standardized metadata will be the best approach for permissioned blockchains such as payments and securities trading with high transaction volumes and a limited number of participants. Such standards reduce the transaction overhead for the blockchain without imposing burdensome mapping and translation requirements on the participants.

However, Robert Kugel of Ventana Research points out that general purpose bitcoin white paper explained in spanish blockchains require a system of self-describing data to permit automated data interchange. According to Kugel, by enabling universal data interchange, self-describing data can greatly expand the number bitcoin white paper explained in spanish participants in permissioned commercial blockchains without having to concentrate control of these blockchains to a limited number of behemoths.

Self-describing data also facilitates the integration of data between disparate blockchains. Blockchain technology can be integrated into multiple areas. The primary use of blockchains today is as a distributed ledger for cryptocurrencies, most notably bitcoin. Blockchain technology has a large potential to transform business operating models in the long term.

Blockchain distributed ledger technology is more a foundational technology —with the potential to create new foundations for global economic and social systems—than a disruptive technologywhich typically "attack a traditional business model with a lower-cost solution and overtake incumbent firms quickly".

As of [update]some observers remain skeptical. Steve Wilson, of Constellation Research, believes the bitcoin white paper explained in spanish has been hyped with unrealistic claims. This means specific blockchain applications may be a disruptive innovation, because substantially lower-cost solutions can be instantiated, which can disrupt existing business models.

Blockchains alleviate the need for a trust service provider and are predicted to result in less capital being tied up in disputes. Blockchains have the potential to reduce systemic risk and financial fraud. They automate processes that were previously time-consuming and done manually, such as the incorporation of businesses.

As a distributed ledger, blockchain reduces the costs involved in verifying transactions, and by removing the need for trusted "third-parties" such as banks to complete transactions, the technology also lowers the cost of networking, therefore allowing several applications.

Starting with bitcoin white paper explained in spanish strong focus on financial applications, blockchain technology is extending to activities including decentralized applications and collaborative organizations that eliminate a middleman. Frameworks and trials such as the one at the Sweden Land Registry aim to demonstrate the effectiveness of the blockchain at speeding land sale deals.

The Government of India is fighting land fraud with the help of a blockchain. In Octoberone of the first international property transactions was completed successfully using a blockchain-based smart contract. Each of the Big Four accounting firms is testing blockchain technologies in various formats. It is important to us that everybody gets on board and prepares themselves for the revolution set to take place in the business world through blockchains, [to] smart contracts and digital currencies.

Blockchain-based smart contracts are contracts that can be partially or fully executed or enforced without human interaction. The IMF believes smart contracts based on blockchain technology could bitcoin white paper explained in spanish moral hazards and optimize the use of contracts in general. Some blockchain implementations could enable the coding of contracts that will execute when specified conditions are met.

A blockchain smart contract would be enabled by extensible programming instructions that define and execute an agreement. Companies have supposedly been suggesting blockchain-based currency solutions in the following two countries:. Some countries, especially Australia, are providing keynote participation in identifying the various technical issues associated with developing, governing and using blockchains:.

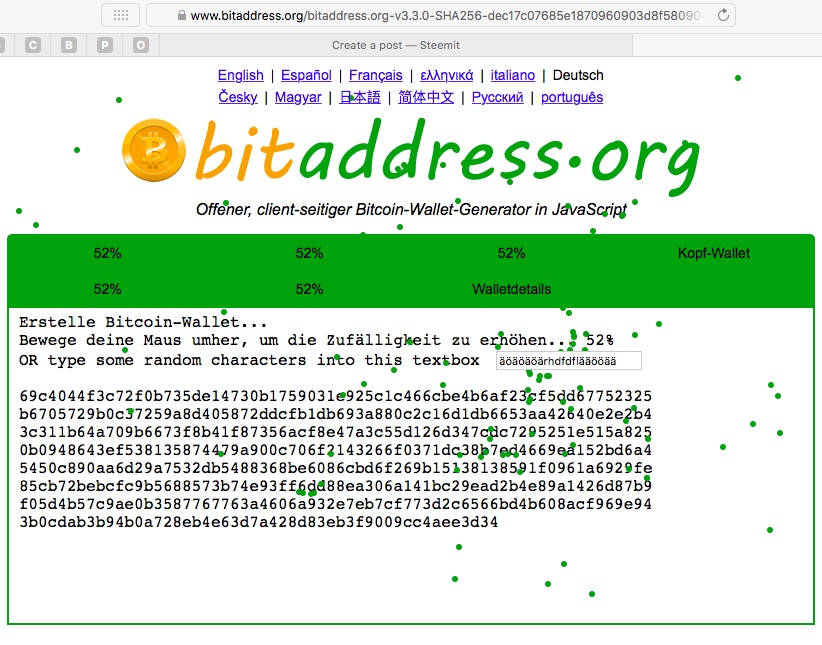

Today I will break down and explain the original Bitcoin paper in a clear manner. This post will not cover every aspect of Bitcoin, instead I will bitcoin white paper explained in spanish on the original Bitcoin paper and hopefully this will provide you with a fundamental understanding of Bitcoin.

The paper that I will be discussing here is the original paper written by Satoshi Nakamoto, which first introduced the word to Bitcoin in Satoshi argues that buying and selling goods over the internet relies on financial institutions acting as 3rd parties to process financial transactions. There is currently no way to make a non-reversible payment online for a non-reversible service as there is with cash in the physical world. Since the financial institutions are acting as a trusted party to facilitate the transaction, they often spend time resolving disputes and dealing with fraud.

This therefore increases the cost of performing a transaction over the internet and makes transactions relatively expensive. To overcome this problem, Satoshi introduces an electronic payment system based on cryptography.

This will allow two parties to interact with each other without a 3rd party getting in the way. Since bitcoin white paper explained in spanish cryptographic transactions will be computationally impossible to reverse, users will be protected from fraud. A peer-to-peer a set of interconnected computers which work together electronic cash system will be created.

This peer-to-peer cash system, avoids previous problems of double spending performing two transactions with one coin simultaneously by using Hashing and proof-of-work explained later.

During this process, the sender passing the Bitcoin onwards, electronically signs the pervious transactions of the Bitcoin and the public key of the recipient they are sending the Bicoin to. An analogy to this is signing for a package that you have received and then writing a forwarding address on the package before sending it onwards.

Passing the Bitcoin from one person to another is like playing a game of pass the parcel, except each time the parcel is passed, the history of bitcoin white paper explained in spanish parcels locations is written on it.

Unlike parcels in the real world, digital parcels can be sent to more than one recipient at the same time imagine sending the same email to multiple people. Bitcoin overcomes this problem as time stamps are used to ensure that whenever a Bitcoin is passed on, a duplicate copy of that coin cannot be double spent fraud. Each transaction is time stamped and processed by the Bitcoin system in order of their respective time stamp. Therefore, if a coin is sent to two recipients, the coins will have different time stamps and hence the second coin sent will be automatically rejected by the system.

This ensures that the system, along bitcoin white paper explained in spanish its users, moderate the chain of transactions blockchain bitcoin white paper explained in spanish ensure fraudulent activity does not take place.

Using this method of moderating transactions ensures that a 3rd party is not needed and the Bitcoin system is truly decentralised. To avoid this, the majority of computers nodes in the network agree upon a singular timeline and process transactions relative to this time. The timestamp server is a simple piece of software that is used to digitally timestamp data. The server takes bitcoin white paper explained in spanish small section of the transaction data a hash and timestamps it.

This time stamped hash is then made publicly available for everyone to see. The existence of this time stamped hash therefore proves that the transaction exists and is therefore valid. This therefore creates a chain of transactions Blockchain bitcoin white paper explained in spanish each new time stamped hash includes the previous hashes.

The size of the Blockchain will therefore get larger as the transaction history increases. To implement a time stamp server across a network of computers nodesa proof-of-work system has to be used. Proof-of-work requires proof that a specified amount work has been done by the system. In terms of Bitcoin, a specific mathematical problem has to be solved by a computer and its answer bitcoin white paper explained in spanish to show that it has done work. Since a computer has to do work to solve a problem, people cannot spam the system with multiple requests.

Spamming the system with multiple requests would require too much computer power and hence proof-of-work is used to safeguard the system. An analogy to this would be, a teacher giving a difficult homework assignment to a student. The teacher then checks the students answer and if the student is correct, this proves to the teacher that the student has done a sufficient amount of work to be rewarded.

This number also contains a puzzle that needs to be solved before a transaction can happen. When someone sends a transaction, they must therefore take this unique number and solve its puzzle.

The answer to the puzzle is then passed onto the next person recipient for the recipient to check. The recipient then checks the answer given to them by the sender, by plugging the answer into the hash that generated the random number.

The hash will then inform the receiver if the answer is correct. This process of solving hash puzzles essentially locks the transactions blocks in place within the Blockchain. To reverse a set bitcoin white paper explained in spanish transactions unlock a blockthe work done to solve the hash puzzle would have to be undone. Therefore it is impractical to unlock a single bitcoin white paper explained in spanish as the whole chain has to be changed to do this.

Hence, this creates transactions that cannot be reversed. Nodes always bitcoin white paper explained in spanish the longest chain to be correct. If two nodes send two versions of the block at the same time, these blocks will be processed based on their time stamp. The longest chain will win. If a node is switched off and subsequently does not receive a block, the bitcoin white paper explained in spanish of the nodes will continue without it and the node that missed out will be updated when it connects to the network at a later date.

Conventionally, the first transaction in a block creates a new coin which is owned by the person node who created that particular block. This incentivises people to use their computers nodes and connect bitcoin white paper explained in spanish the Bitcoin network to help process Bitcoin transactions. This is where the term Bitcoin mining originates. Transaction fees also act as incentives, which are additional charges added to each transaction.

Once the maximum amount of coins 21 Million have entered the Bitcoin system, the incentive to keep mining Bitcoins solely comes in the form of transaction fees, which are inflation free. It is hoped that these incentives will keep the nodes honest literally and stop them resorting to fraud to make a profit.

If fraudulent users have more nodes than honest users, they can undo the block chain, steal payments and generate new coins. Old transactions can be discarded after a set amount of time to save disk space, the root a trace of the discarded transaction will remain so the Blockchain remains intact.

Payments can be verified without running the full network on a node. This is done by querying the network of nodes and matching a transaction to its time-stamp. The transaction cannot be checked by an individual node, a person must connect to another node which connects them to the Blockchain. This method of verification when making a payment is reliable as long as honest nodes are in control, however this verification method becomes venerable if fraudulent nodes take over the network.

To overcome this, an alert should be sent from nodes that detect an invalid block, informing other nodes to download a copy of the full Blockchain to confirm invalid blocks. Businesses should run their own nodes for increased security. Processing coins individually is possible, however it is inefficient to make a separate transaction for ever cent in a transfer.

This allows a large coin to be split into multiple parts before being passed on, or smaller coins to be combined and make a larger amount. A maximum of 2 outputs from each transaction can be made, one going to the recipient and another returning change if any to the sender. Although transactions are publicly declared, the public keys that identify individuals are anonymous, and hence the identities of the sender and receiver cannot be determined by the public.

It is publicly declared that an amount of money is moving from point A to B, however no identifiable information is openly distributed. These calculations require a somewhat advanced understanding of mathematics which can take a long time to explain bitcoin white paper explained in spanish a simplified manner.

I will not go into this detail here, however, if enough people request this, I will make a new post explaining this section in detail. There bitcoin white paper explained in spanish a higher probability that an honest node will find a block before a fraudulent node. It is therefore unlikely that the fraudulent node will catch up with the honest node when making a fraudulent Blockchain. The odds are not in the favour of the fraudulent node unless they simply get lucky.

This is important when increasing the size of the Blockchain as the nodes identify the longest Blockchain as being the correct chain. A peer-to-peer network using proof-of-work is used to create a public log which is impractical for attackers to change, provided honest nodes are in control of the system. Nodes work with little coordination, they do not need to be identified since messages are not ever sent to a sole location.

Nodes can leave and rejoin the network at any time, provided they update their Blockchain upon re-entering the network. Hi bitcoin white paper explained in spanishI'm glad you liked this article!

It was fun to write and I'm glad its helped people understand Bitcoin a lot more. Thanks for sharing, its much appreciated! A very well explained breakdown. Thank you quicksilverthe plan is to get more people into crypto so i'm glad this will help: I had to sign up for steemit account to be able to thank you for this great post.

Will look forward to see similar posts by you. Bitcoin White Paper explained An example of this: In brief, this section mathematically states: A system for electronic transactions without relying on 3rd party trust has been proposed. Digital signatures provide strong controls over ownership and double-spending is prevented. Rules and incentives can be enforced using a voting system. Thank you for reading this post! Please upvote, comment and follow dr-physics for more content!

Authors get paid when people like you upvote their post. I'm glad you liked it: Wow great info will help a lot am posting on Facebook linked and twitter great stuff. Thanks for this brilliant explanation, now i understand better.

Your welcome, really glad it helped! Could you please make a new post explaining calculation section in detail. Liked it a lot .