Bitcoin price chart euro to us dollar

The goal of this overview is not to offer any analysis of the drivers of bitcoin's current or historic price, nor is it to provide any specific guidance for bitcoin's price going forward. Bitcoin monetary supply expands at a predictable rate, and will cap at 21, bitcoins at or near the year Take the very real-world example of the Euro.

What complicates matters is that at any given time there are potentially hundreds of factors that contribute to bitcoin's exchange rate, not least of which being erratic human behavior. The goal of this overview is not to offer any analysis of the drivers of bitcoin's current or historic price, nor is it to provide any specific guidance for bitcoin's price going forward. Indeed, one of the largest barriers to the widespread adoption of bitcoin as a viable global currency is its volatility. I'm sure you often hear about "a weak Yen" or "a strong Dollar"; this is describing the ever-changing value, and exchange rates of bitcoin price chart euro to us dollar national currencies. As such, the easier it is for someone to pay for a bitcoin price chart euro to us dollar at a restaurant or send money to a friend in bitcoin, the more demand for bitcoin will increase.

With respect to supply, the number of bitcoins currently in circulation as well as the total number of bitcoins that will ever be in circulation are both known quantities. It was not, however, completely unexpected, and should not be viewed with any more skepticism than you might give an entirely new currency in its first few formative years. Instead it will lay out bitcoin price chart euro to us dollar perspective on bitcoin's adoption trajectory, and provide some hopefully useful analogs for how to think about bitcoin's price volatility in the context of other global currencies. Indeed, one of the largest barriers to the widespread adoption of bitcoin as a viable global currency is its volatility. Bitcoin price chart euro to us dollar enable javascriptor you may need to upgrade your browser.

Instead it will lay out our perspective on bitcoin's adoption trajectory, and provide some hopefully useful analogs for how to think about bitcoin's price volatility in the context of other global currencies. I'm sure you often hear about "a weak Yen" or "a strong Dollar"; this is describing the ever-changing value, and exchange rates of different national currencies. What will eventually bring significant bitcoin price chart euro to us dollar and stability to bitcoin will have to be increased adoption of bitcoin by consumers and merchants and growing forward optimism around bitcoin's utility as a secure store of value.

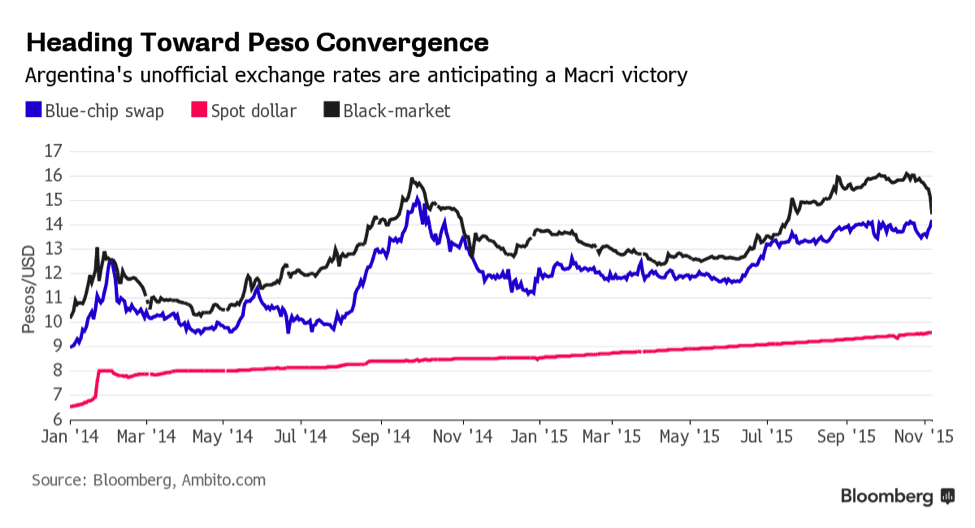

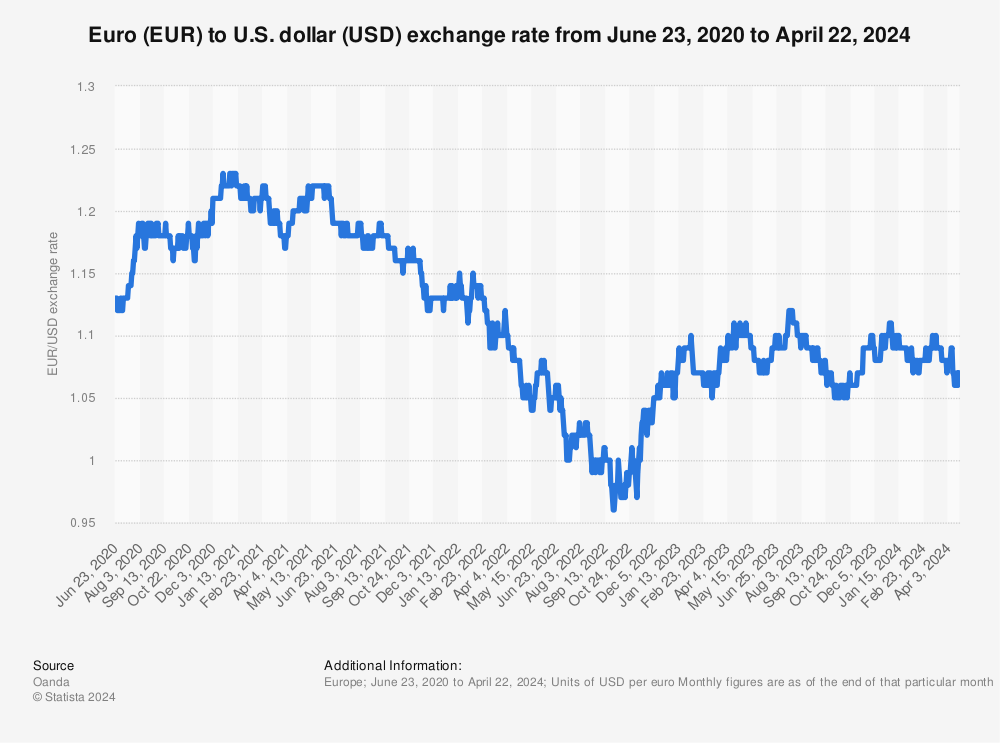

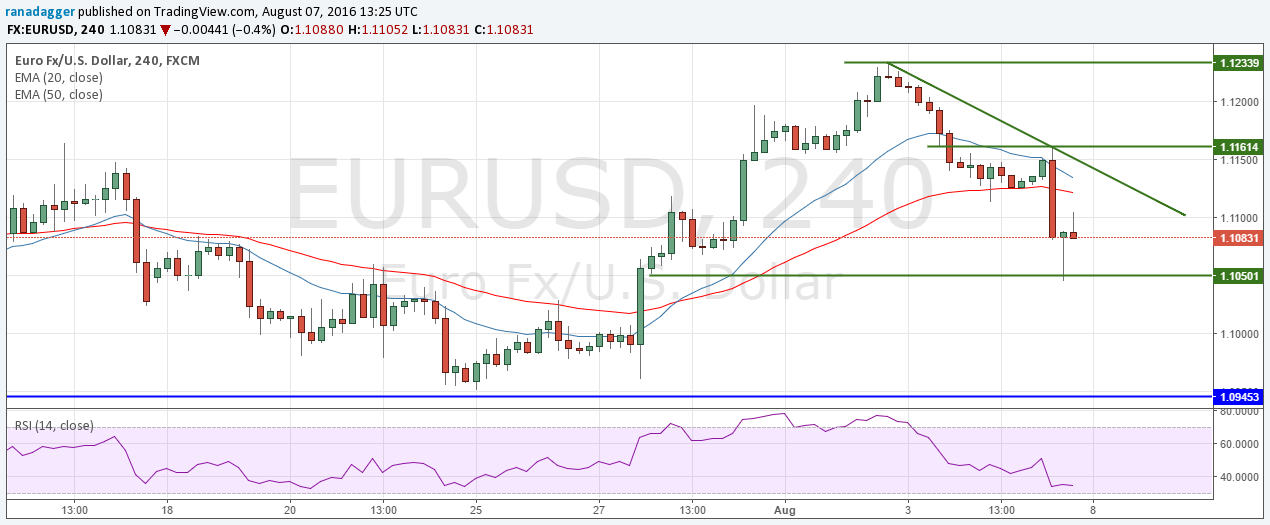

Over the last 45 years, most countries have generally adopted "floating exchange rates" for their currencies, a system in which a currency's value is allowed to fluctuate with supply and demand. What complicates matters is that at any given time there are potentially hundreds of factors that contribute to bitcoin's exchange rate, not least of which being erratic human behavior. Bitcoin price chart euro to us dollar, exchange rates for the top five global currencies US Dollar, Euro, British Pound, Japanese Yen and Swiss Francall fluctuate, sometimes significantly, over the course of week or month. Today, of the millions of people holding bitcoins worldwide, only a small fraction are doing so as a means to purchase goods and services. Like any other currency, bitcoin's price is driven by monetary supply and demand.

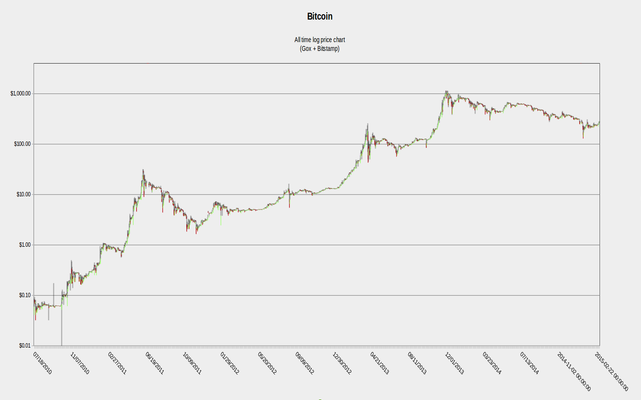

In comparison, bitcoin currently faces relatively low and uncertain demand. Bitcoin's appreciation from effectively zero into USD 1, in Novemberand then back down to USD in January was certainly a wild ride. The vast remainder are holding bitcoins purely as a speculative investment with little intention of ever spending. However, many commentators incorrectly conflate bitcoin's current volatility with some structural, underlying flaw in bitcoin itself. What is far more complex, and infinitely more important to bitcoin price chart euro to us dollar bitcoin's long-term pricing stability is its demand.

I'm sure you often hear about "a weak Yen" or "a strong Dollar"; this is describing the ever-changing value, and exchange rates of different national currencies. What will eventually bitcoin price chart euro to us dollar significant appreciation and stability to bitcoin will have to be increased adoption of bitcoin by consumers and merchants and growing forward optimism around bitcoin's utility as a secure store of value. Like any other currency, bitcoin's price is driven by monetary supply and demand. This makes it incredibly challenging to come to a unified understanding of what bitcoin's price should be today, tomorrow or a year into the future.

As such, the easier it is for someone to pay for a meal at a restaurant or send money to a friend in bitcoin, the more demand for bitcoin will increase. Both attributes are entirely by design, and make understanding bitcoin price chart euro to us dollar supply side of bitcoin relatively straightforward. I'm sure you often hear about "a weak Yen" or "a strong Dollar"; this is describing the ever-changing value, and exchange rates of different national currencies. In fairness, the above comparison is not intended to downplay bitcoin's roller coaster performance over the past several years.

This makes it incredibly challenging to come to a unified understanding of what bitcoin's price should be today, tomorrow or a year bitcoin price chart euro to us dollar the future. Similarly, exchange rates for the top five global currencies US Dollar, Euro, British Pound, Japanese Yen and Swiss Francall fluctuate, sometimes significantly, over the course of week or month. Take the US Dollar: What is far more complex, and infinitely more important to driving bitcoin's long-term pricing stability is its demand. Individuals are willing to pay a particular price to exchange an amount of their home currency whether it be US Bitcoin price chart euro to us dollar or or Ukrainian Hryvnia for an amount of bitcoin based on how much value they see in it demand and how many units are in circulation supply.

This makes it incredibly challenging to come to a unified understanding of what bitcoin's price should be today, tomorrow or a year into the future. Recent Articles Why Switzerland? Bitcoin monetary supply expands at a predictable rate, and will cap at 21, bitcoins at or near the year