Bitcoin day trader app

It is available for both Android and iOS. Using fully encrypted API application programming interface keys, it is possible to link the accounts on exchanges to the TabTrader app so that you can trade on-the-go.

On the app, you are able to buy and sell cryptocurrencies, analyze charts as well as view your portfolio balance. However, the platform does not have the permission to withdraw any funds.

This adds a layer of security to your funds. In order to make the best use of the app, it is best to have some knowledge of trading and the cryptocurrency market, however, it is easy to learn how to use the app as it has a simple and easy-to-use user interface.

It also provides a charting tool that enables users to analyze price movements. You can trade directly from the charts or manually input trade orders. Moreover, the application has no advertisements, which allows you to trade without any time-wasting interruptions. To further enhance your security, you can set it to require a pin before allowing access. TabTrader does not take up much space on your phone and can alert you to market movements through push notifications.

CoinStats is a simple but highly useful crypto portfolio tracker. This mobile app is available for both Android and iOS devices. It features an easy-to-use interface and a pleasant design.

CoinStats helps you to easily keep track of your portfolio as you are able to view the amounts you are holding in each digital currency. You are also able to view how much your crypto portfolio is worth in accordance with market movements.

Moreover, you can set it to send you an alert when the price goes lower or higher than your desired amount. CoinStats also features a converter that helps you to figure out what an amount in a certain currency, say bitcoin, is in other digital currencies.

If your portfolio is less than USD 5, then the application is free. Ethereum hit the scene with the promise of using the blockchain for more than just currencies. You could build decentralized apps on top of Ethereum and even new currencies.

I wondered if I could take advantage of those swings by buying when the price was low, selling when it was high, and buying back in when the price dipped again. In the same period I shut down my company, Bitfountain , after running it for 5 years. Bootstrapping my own company gave me an unprecedented amount of freedom. I lived in 4 countries, traveled to many more, and only worked a few hours per day.

However, since the company had run its course, I needed a new source of income. I applied for only one job as a software engineer. It was the kind of job people love - high salary, all the Silicon Valley benefits, friendly team, well funded company, challenging engineering problems. After three rounds of interview they decided not to move forward with me. I did want it. But I also feared losing my freedom. Gone would be the days where I could spontaneously book a flight to India with no return date.

Going through the interview process made the possibility of losing my freedom real. I went into panic mode searching for a way I could make money on my own. At this point I still owned Ethereum and the price was still swinging back and forth. I signed up for two exchanges: I needed Poloniex as well because there were many cryptocurrencies being traded there Altcoins - cryptocurrerncies that are not BTC.

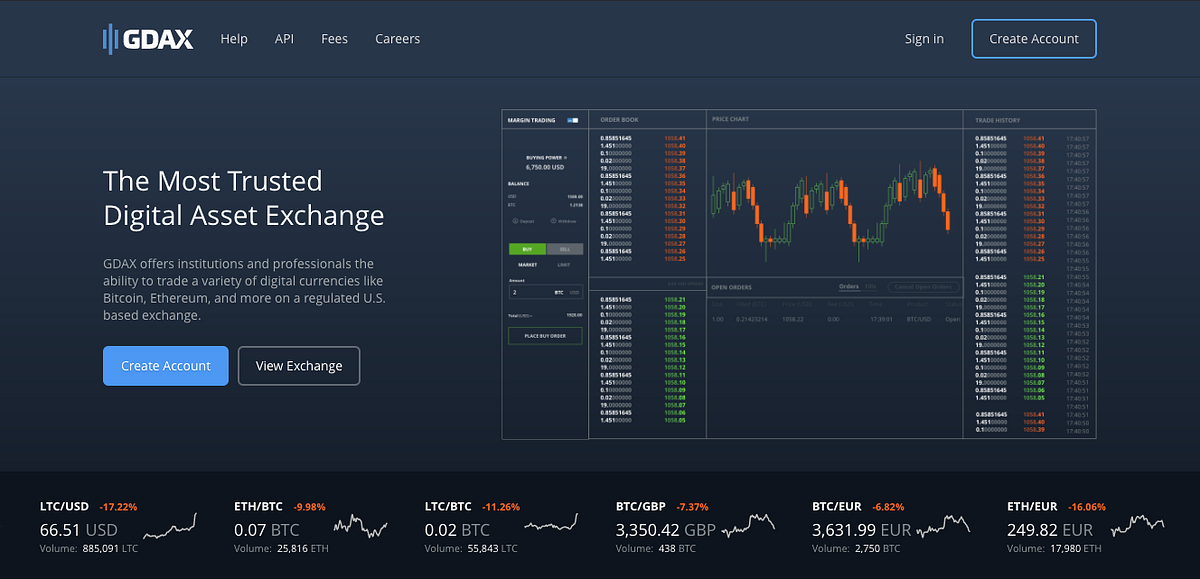

Those are the first two exchanges that I used. Now I use others since each exchange has pros and cons. A live crypto exchange is intimidating at first glance. There are charts and numbers changing at the speed of sight.

I felt overwhelmed but sat through the confusion to try and make sense of what I was looking at. Soon I could see where to place orders to buy and sell, and the charts started to make sense too. As the month went on I spent hours trading. I made enough to pay my rent, so the possibility of making a living from this was validated.

I wanted to formalize my trading knowledge so I could do more than buy low and sell high. There had to be a real strategy to this stuff. I read as many books as I could on trading stocks and foreign exchange markets. I made a lot of mistakes. But eventually I found my rhythm and strategies. For myself, and most crypto traders, the goal is to increase the amount of Bitcoin we own. For example, right now the price of 1 ETH Ethereum is 0.

Another thing I need to make clear is the type of trading I do - day trading. All of my profits are converted back into BTC at the end of each trading day.

Again, even though I buy and sell several Altcoins, at the end of the day my net worth is in Bitcoin. There are three reasons for this:. I earn more USD when the price of Bitcoin goes up against the dollar.

Why was it important to clear this up? Several things were on my mind the first time I had to do this. What if I sell my BTC now and the price shoots up tomorrow? Yes, but your bills will be paid. Sell now so you can pay your rent. You can always hold out for more, but at the same time you are risking a loss.

I can live a nice middle class lifestyle in Los Angeles. Or I can drive a flashy car while I rent a crappy apartment in Los Angeles.

It all comes down to your values. In fact, if i see a chart like this I almost always ignore it:. The wild bull runs are hard to find, hard to time properly, and easy to go in the opposite direction where you lose a lot. Those gains are only exciting if you understand how far they can get you. Of course the numbers above assume you trade days per year. Not many people are willing to forego vacation and weekends to work as a full time crypto trader, even with numbers like that.

Not only that but I also let my emotions control my trades. For example, I once purchased Stratis after the price dropped massively. My assumption was that on such a sharp decrease in price, it had to rebound eventually. The price kept diving. I was constantly tuned into that chart waiting for an opportunity to sell back to Bitcoin. Now I have my strategy that I stick to without letting my emotions interfere.

I have a set of coins that I like trading so I only look at those charts. I have patterns and indicators that I look for on those charts so I can quickly flip through them. Within minutes I can set my orders, set alerts on my desired entry and exit prices, and walk away from the computer. As the market cap of crypto increases, be sure that the IRS is going to find out how to get their slice. And they will look into the past.

I am not a tax advisor. This is a simple overview of what I keep in mind as I trade. My accountant handles my taxes, and I advise you to get an accountant to do the same. Keep in mind that this is US-centric. You need to double check if this is the case in your country. The taxable event is when you sell your cryptocurrency for fiat.

How much tax you pay depends on how long you were holding the cryptocurrency. Buy crypto with fiat - no tax. Sell crypto for fiat - pay ordinary income tax. Buy crypto with crypto - unclear, but does not seem to be a taxable event. This is where things get foggy. Consult your advisor, but as far as I know this is a like-kind exchange which is not taxable but must be reported to the IRS.

The exchange you use will output all of these transactions so you can hand them to your accountant. The IRS has clarified that a crypto to crypto exchange is not a like-kind exchange. The profit made from each transaction is taxed. If you are holding a currency for more than a year it is classified as long term capital gains. This is another reason why I like keeping my net worth in Bitcoin. At least not right now. Passive income is great.

After you make an initial investment, you mostly sit back and watch the money roll in. Most cryptocurrencies are mined. You invest in a very strong computer and the electricity to run it, and you are rewarded with crypto for contributing to the network as a node that confirms blockchain transactions.

This is an alternative to mining that does not require vast amounts of electricity. The idea is that you stake the cryptocurrency that you own over a wifi connection. That crypto that you stake is used to validate transactions on the blockchain, and you are rewarded more cryptocurrency for putting the currency you own in the pool.