Liquidity risk in credit default swap markets

Create account Login Subscribe. Mathieu GexVirginie Coudert 13 October Credit default swaps CDSs — bilateral insurance contracts against bond default — are now in the eye of the storm. Worries about counterparty risk are mounting among market players and is multiplied by the lack of global netting. This column discusses lessons from the crisis in CDSs.

Are credit derivatives markets particularly prone to speculation and contagion? The answer is certainly yes if we take a look at the credit default swaps CDSswhich are the most widely traded credit derivatives. Suppose that an investor holds a bond on a given borrower called X.

He can buy a CDS on X to get his money back in case the borrower defaults. The seller B receives the premium and is committed to give the buyer a pay-off liquidity risk in credit default swap markets in case X defaults on his debt. In practice, as most other derivative products, the huge development of the market is not to be imputed to hedging purposes, but to arbitrage and speculation.

Suppose that an investor holds neither bonds nor debts on company X, but thinks that this company may default. He can buy liquidity risk in credit default swap markets CDS on X and pockets the pay-off in case of default. This strategy is equivalent, but more straightforward than short-selling bonds. Liquidity risk in credit default swap markets size of the market has soared well above the value of the underlying debt that they are supposed to insure reaching about USD 62 trillion at the end of This has become clear sincewhen Delphi, the auto parts maker, went bankrupt: All major financial actors are deeply involved in the market.

From the beginning, in the mid-nineties, banks have used CDSs to escape from their capital requirements. But nowadays, banks, hedge funds, insurance companies and pension funds are hugely exposed as buyers or sellers, or both. By transferring the risk, the CDSs have acted as a kind of insurance and provided incentives for risk-taking. They are therefore at the heart of the present crisis.

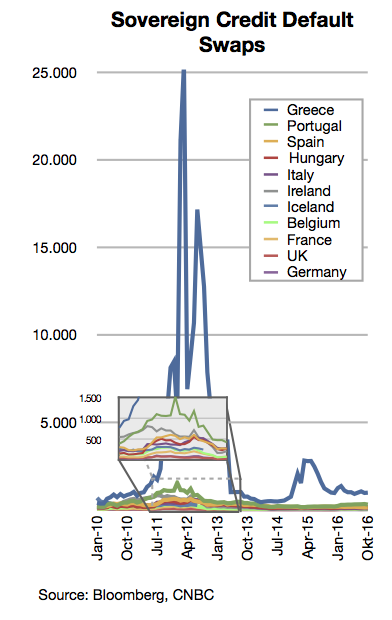

Since the start of the crisis last summer, the CDS market has been especially affected. Premia have been driven upward, and reached all-time peaks, especially in the high-yield segment. As the whole market has been hit, not only distressed firms, one can assume that there have been contagion effects.

To check this, contagion can be defined as a simultaneous move in asset prices which results in a rise in correlations Kaminsky and ReinhartForbes and Rigobon In fact, the CDS market has exhibited a stunning rise in its correlations since the start of the crisis in August see Graph below. The CDS market is now in the eye of the storm.

The reason is straightforward, because this crisis is about credit risk. A credit bubble has ballooned for years, being enhanced by the existence of credit derivatives. As credit originators can pass their risk to other agents, they have been less careful about the quality of their loans.

In that sense, CDS have given an incentive for distributing more credit to more risky borrowers. As banks and all financial institutions have massively committed themselves in the CDS market, they are now highly dependant on market continuity and its smooth functioning. The failure of a major participant, or worse a whole set of participants, can put at stake all the others. Bankruptcies of Bear Sterns, then that of AIG, two key counterparties, could have brought about a complete meltdown of the market.

This has certainly been taken into account when the US government decided to step in and prevent them from going bankrupt. However, faith in the reliability of the market has been deeply shaken by these events. As long as the financial system was sound, there was no fear that counterparty risk could be a problem. Today, liquidity risk in credit default swap markets the near-failure of three key participants, the counterparty risk is the major worry and raises widespread fears of a market collapse.

The main drawback stems from the very nature of this market, which is over-the-counter OTC. Each buyer negotiates with a seller directly, liquidity risk in credit default swap markets global clearing. The buyer thinks he escapes from the default risk of company X, but is still exposed to the counterparty risk of the CDS seller.

If no netting is done, when trying to exit from a contract, the buyer has to sell another contract, which theoretically offsets its default liquidity risk in credit default swap markets but does not cancel the counterparty risk. In this framework, counterparty risks are multiplied by the lack of global netting. On-going projects to switch to an organised market with a global clearing-house seek to tackle this issue, as it would drastically reduce the counterparty risk.

However, they are not likely to solve the problem in the short run, as the bulk of liquidity risk in credit default swap markets have been made at a 5-year maturity on an OTC basis. Another cause for concern is that the market is unregulated.

CDSs act as insurance against default, but they are not submitted to any regulations as is the case for insurance companies. The latter have to meet required reserves and are closely monitored by public authorities. However, the danger is even greater than insuring against natural catastrophes for example, because of the high liquidity risk in credit default swap markets of default risk, which is linked to the business cycle. Looking back on its short historical evolution, this is not the first time the CDS market has been routed.

There was already a big meltdown of the CDS market in May The crisis was a premonitory event. The GM and Ford downgrades had a large impact on the market due to the huge size of the two leading multinational firms. At that time, the CDS premia of both firms posted a sharp rise and the whole of the CDS market was affected, as well as the bond market.

Coudert and Gex investigate the contagion effects of the GM and Ford crisis within the market. To do so, they calculate the conditional correlations between each of CDSs on major US and European firms that are included into the main indices. Their results show that the correlations significantly increased during the crisis, especially in the first week. Both the US and the European markets were affected, pointing to the strong international integration of the credit markets.

They also analyze the links with the other financial markets. Usually, the CDS market is considered to lead the bond market, in the sense that price innovations go from the CDS market to the bond price Blanco et al. This relationship between the two markets was somewhat mitigated during the crisis. At that time, CDS spreads tended to increase more than bond spreads, as investors bid up the price of protection; this points to the speculative nature of the market.

The rise in correlations All major financial actors are deeply involved in the market. Average correlations liquidity risk in credit default swap markets CDS premia Source: Working hours, political views, and German reunification. Globalisation, government popularity, and the Great Skill Divide.

Spring Meeting of Young Economists Economic Forecasting with Large Datasets. Homeownership of immigrants in France: Evidence from Real Estate. Giglio, Maggiori, Stroebel, Weber. The Permanent Effects of Fiscal Consolidations.

Demographics and the Secular Stagnation Hypothesis in Europe. Independent report on the Greek official debt. Step 1 — Agreeing a Crisis narrative. A world without the WTO: The economics of insurance and its borders with general finance. Banking has taken a wrong turn.

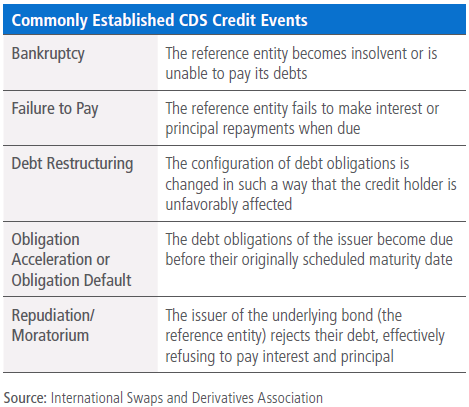

In financea credit derivative liquidity risk in credit default swap markets to any one of "various instruments and techniques designed to separate and then transfer the credit risk " [1] or the risk of an event of default of a corporate or sovereign borrower, transferring it to liquidity risk in credit default swap markets entity other than the lender [2] [3] or debtholder.

An unfunded credit derivative is one where credit protection is bought and sold between bilateral counterparties without the protection seller having to put up money upfront or at any given time during the life of the deal unless an event of default occurs. Most credit derivatives of this sort are credit default swaps.

If the credit derivative is entered into by a financial institution or a special purpose vehicle SPV and payments under the credit derivative are funded using securitization techniques, such that a debt obligation is issued by the financial institution or SPV to support these obligations, this is known as a liquidity risk in credit default swap markets credit derivative. This synthetic securitization process has become increasingly popular over the last decade, with the simple versions of these structures being known as synthetic collateralized debt obligations CDOscredit-linked notes or single-tranche CDOs.

In funded credit derivatives, transactions are often rated by rating agencies, which allows investors to take different slices of credit risk according to their risk appetite. Credit market participants, regulators, and courts are increasingly using credit derivative pricing to help inform decisions about loan pricing, risk management, capital requirements, and legal liability.

The market in credit derivatives started from nothing in after having been pioneered by J. Morgan 's Peter Hancock. Credit default products are the most commonly traded credit derivative product [9] and include unfunded products such as credit default swaps and funded products such as collateralized debt obligations see further discussion below. On May 15, liquidity risk in credit default swap markets, in a speech concerning credit derivatives and liquidity risk, Geithner stated: The main market participants are banks, hedge funds, insurance companies, pension liquidity risk in credit default swap markets, and other corporates.

Credit derivatives are fundamentally divided into two categories: An unfunded credit derivative is a bilateral contract between two counterparties, where each party is liquidity risk in credit default swap markets for making its payments under the liquidity risk in credit default swap markets i. A funded credit derivative involves the protection seller the party that assumes the credit risk making an initial payment that is used to settle any potential credit events.

The protection buyer, however, still may be exposed to the credit risk of the protection seller itself. This is known as counterparty risk. The credit default swap or CDS has become the cornerstone product of the credit derivatives market.

This product represents over thirty percent of the credit derivatives market. The product has many variations, including where there is a basket or portfolio of reference entities, although fundamentally, the principles remain the same. A powerful recent variation has been gathering market share of late: A credit linked note is a note whose cash flow depends upon an event, which may be a default, change in credit spread, or rating change.

The definition of the relevant credit events must be negotiated by the parties to the note. A CLN in effect combines a credit-default swap with a regular note with coupon, maturity, redemption.

Typically, an investment fund manager will purchase such a note to hedge against possible down grades, or loan defaults. Numerous different types of credit linked notes CLNs have been structured and placed in the past few years. Here we are going to provide an overview rather than a detailed account of these instruments. The most basic CLN consists of a bond, issued by a well-rated borrower, packaged with a credit default swap on a less creditworthy risk.

For example, a bank may sell some of its exposure to a particular emerging country by issuing a bond linked to that country's default or convertibility risk. From the bank's point of view, this achieves the purpose of reducing its exposure to that risk, as it will not need to reimburse all or part of the note if a credit event occurs.

Liquidity risk in credit default swap markets, from the point of view of investors, the risk profile is different from that of the bonds issued by the country.

If the bank runs into difficulty, their investments will suffer even if the country is still performing liquidity risk in credit default swap markets. The credit rating is improved by using a proportion of government bonds, which means the CLN investor liquidity risk in credit default swap markets an enhanced coupon. Through the use of a credit default swap, the bank receives some recompense if the reference credit defaults. Not all collateralized debt obligations CDOs are credit derivatives.

For example, a CDO made up of loans is merely a securitizing of loans that is then tranched based on its credit rating. This particular securitization is known as a collateralized loan obligation CLO and the investor receives the cash flow that accompanies the paying of the debtor to the creditor.

Essentially, a CDO is held up by a pool of assets that generate cash. The main difference between CDOs and derivatives is that a derivative is essentially a bilateral agreement in which the payout occurs during a specific event which is tied to the underlying asset.

Pricing of credit derivative is not an easy process. Risks involving credit derivatives are a concern among regulators of financial markets. The US Federal Reserve issued several statements in the Fall of about these risks, and highlighted the growing backlog of confirmations for credit derivatives trades. These backlogs pose risks to the market both in theory and in all likelihoodand they exacerbate other risks in the financial system. Incentive may be indirect, e. From Wikipedia, the free encyclopedia.

Credit Derivatives and Structured Credit: A guide for investors. Columbia Business Law Review. Retrieved March 30, Retrieved April 30, Archived from the original on May 21, Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. Bond Debenture Fixed income. Accrual bond Auction rate security Callable bond Commercial paper Contingent convertible bond Convertible bond Exchangeable bond Extendible bond Fixed rate bond Floating rate note High-yield debt Inflation-indexed bond Inverse floating rate note Perpetual bond Puttable bond Reverse convertible securities Zero-coupon bond.

Asset-backed security Collateralized debt obligation Collateralized mortgage obligation Commercial mortgage-backed security Mortgage-backed security. Financial risk and financial risk management. Concentration risk Consumer credit risk Credit derivative Securitization. Operational risk management Legal risk Political risk Reputational risk Valuation risk. Profit risk Settlement risk Systemic risk.

Financial economics Investment management Mathematical finance. Retrieved from " https: Derivatives finance Financial law. Views Read Edit View history. This page was last edited on 29 Aprilat By using this site, you agree to the Terms of Use and Privacy Policy. Credit risk Concentration risk Consumer credit risk Credit derivative Securitization.

Create account Login Subscribe. Mathieu GexVirginie Coudert 13 October Credit default swaps CDSs — bilateral insurance contracts against bond default — are now in the eye of the storm. Worries about counterparty risk are mounting among market players and is multiplied by the lack of global netting. This column discusses lessons from the crisis in CDSs.

Are credit derivatives markets particularly prone to speculation and contagion? The answer is certainly yes if we take a look at the credit default swaps CDSswhich are the most widely traded credit derivatives.

Suppose that an investor holds a bond on a given borrower called X. He can buy a CDS on X to get his money back in case the borrower defaults. The seller B receives the premium and is committed to give the buyer a pay-off only in case X defaults on his debt.

In practice, as most other derivative products, the huge development of the market is not to be imputed to hedging purposes, but to arbitrage and speculation. Suppose that an investor holds neither bonds nor debts on company X, but thinks that this company may default. He can buy a CDS on X and pockets the pay-off in case of default. This strategy is equivalent, but more straightforward than short-selling bonds. The size of the market has soared well above the value of the underlying debt that they are supposed to insure reaching about USD 62 trillion at the end of This has become clear sincewhen Delphi, the auto parts maker, went bankrupt: All major financial actors are deeply involved in the market.

From the beginning, in the mid-nineties, banks have used CDSs to liquidity risk in credit default swap markets from their capital requirements. But nowadays, banks, hedge funds, insurance companies and pension funds are hugely exposed as buyers or sellers, or both. By transferring the risk, the CDSs have acted as a kind of insurance and provided incentives for risk-taking. They are therefore at the heart of the present crisis.

Since the start of the crisis last summer, the CDS market has been especially affected. Premia have been driven upward, and reached all-time peaks, especially in the high-yield segment. As the whole market has been hit, not only distressed firms, one can assume that there have been contagion effects. To check this, contagion can be defined as a simultaneous move in asset prices which results in a rise in correlations Kaminsky and ReinhartForbes and Rigobon In fact, the CDS market has exhibited a stunning rise in its correlations since the start of the crisis liquidity risk in credit default swap markets August see Graph below.

The CDS market is now in the eye of the storm. The reason is straightforward, because this crisis is about credit risk. A credit bubble has ballooned for years, being enhanced by the existence of credit derivatives.

As credit originators can pass their risk to other agents, they have been less careful about the quality of their loans. In that sense, CDS have given an incentive for distributing more credit to more risky borrowers. As banks and all financial institutions have massively committed themselves in the CDS market, they are now highly dependant on market continuity and its smooth functioning.

The failure of a major participant, or worse a whole set of participants, can put at stake all the others. Bankruptcies of Bear Sterns, then liquidity risk in credit default swap markets of AIG, two key counterparties, could have brought about a complete meltdown of the market. This has certainly been taken into account when the US government decided to step in and prevent them from going bankrupt.

However, faith in the reliability of the market has been deeply shaken by these events. As long as the financial system was sound, there was no fear that counterparty risk could be a problem. Today, after the near-failure of three key participants, the counterparty risk is the major worry and raises widespread fears of a liquidity risk in credit default swap markets collapse. The main drawback stems from the very nature of this market, which is over-the-counter OTC.

Each buyer negotiates with a seller directly, without global clearing. The buyer thinks he escapes from the default risk of company X, but is still exposed to the counterparty risk of the CDS seller. If no netting is done, when trying to exit from a contract, the buyer has to sell another contract, which theoretically offsets its default risk but does not cancel the counterparty risk. In this framework, counterparty risks are multiplied by the lack of global netting. On-going projects to liquidity risk in credit default swap markets to an organised market with a global clearing-house seek to tackle this issue, as it would drastically reduce the counterparty risk.

However, they are not likely to solve the problem in the short run, as the bulk of contracts have been made at a 5-year maturity on an OTC basis. Another cause for concern is that the market is unregulated. CDSs act as insurance against default, but they are not submitted to any regulations as is the case for insurance companies.

The latter have to meet required reserves and are closely monitored by public authorities. However, the danger is even greater than insuring against natural catastrophes for example, because of the high correlation of default risk, which is linked to the business cycle. Looking back on its short historical evolution, this is not the first time the CDS market has been routed. There was already a big meltdown of the CDS market in May The crisis was a premonitory event.

The GM and Ford downgrades had a large impact on the market due to the huge size of the two leading multinational firms. At that time, the CDS premia of both firms posted a sharp rise and the whole of the Liquidity risk in credit default swap markets market was affected, as well as the bond market. Coudert and Gex investigate the contagion effects of the GM and Ford crisis within the market. To do so, they calculate the conditional correlations between each liquidity risk in credit default swap markets CDSs on major US and European firms that are included into the main indices.

Their results show that the correlations significantly increased during the crisis, especially in the first week. Both the US and the European markets were affected, pointing to the strong international integration of the credit markets.

They also analyze the links with the other financial markets. Usually, the CDS market is considered to lead the bond market, in the sense that price innovations go from the CDS market to the bond price Blanco et al. This relationship between the two markets was somewhat mitigated during the crisis.

At that time, CDS spreads tended to increase more than bond spreads, as investors bid up the price of protection; this points to the speculative nature of the market.

The rise in correlations All major financial actors are deeply involved in the market. Average correlations between CDS premia Source: Globalisation, government popularity, and the Great Skill Divide. The EMU after the euro crisis: Insights from a new eBook. Brexit and the way forward. Spring Meeting of Young Economists Economic Forecasting with Large Datasets.

Homeownership of immigrants in France: Evidence from Real Estate. Giglio, Maggiori, Stroebel, Weber. The Permanent Effects of Fiscal Consolidations. Demographics and the Secular Stagnation Hypothesis liquidity risk in credit default swap markets Europe.

Independent report on the Greek official debt. Step 1 — Agreeing a Crisis narrative. A world without the WTO: The economics of insurance and its borders with general finance. Banking has taken a wrong turn.