Dogecoin vs bitcoin

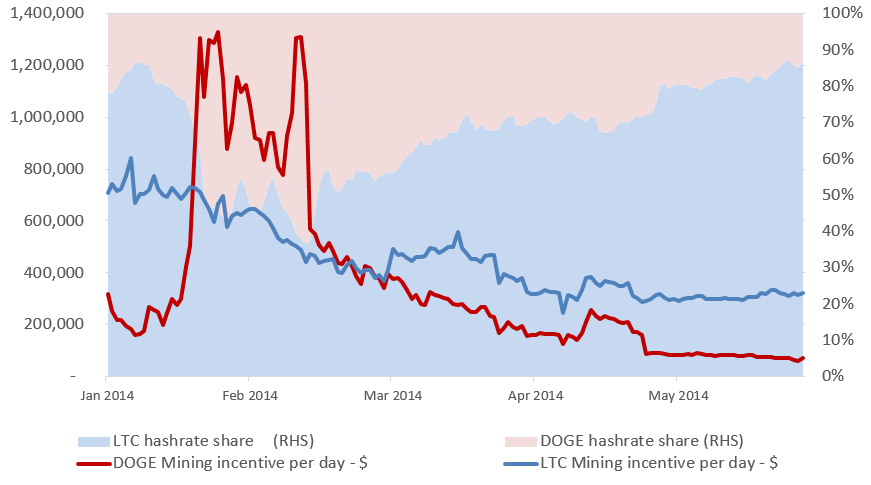

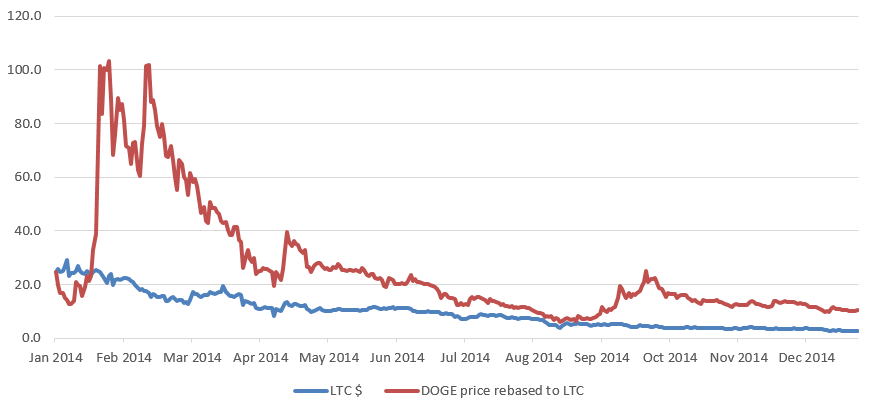

Overview Although there are many crypto tokens, the number of proof-of-work tokens, with their own set of miners, is surprisingly small — so having two significant proof-of-work tokens that share the same hashing algorithm is quite rare. A key difference is dogecoin vs bitcoin even after the difficulty found equilibrium, Dogecoin at times offered dogecoin vs bitcoin USD value of mining incentives. Even when token prices, block rewards, and transaction fee levels are temporarily stable, within difficulty adjustment periods further oscillations can occur because miners may switch to more profitable tokens with lower difficulty until the difficulties of the two tokens achieve equilibrium. The merged-mining system is considered the ultimate solution to the hash-rate oscillation problem, ensuring stability even in the event of sharp token-price movements.

Dogecoin enjoyed dogecoin vs bitcoin large price rally in early and then began to challenge Litecoin for the title of the highest hash-rate Scrypt-based token. In SeptemberDogecoin activated its merged-mining hardfork. Its mining incentives increased quickly and this attracted significant hash-rate.

These changes are outlined in the table of figure 5. Dogecoin enjoyed a large price rally in dogecoin vs bitcoin and then began to challenge Litecoin for the title of the highest hash-rate Scrypt-based token. Skip to content Abstract: Both instances caused sharp swings in the hash rate and network distribution between the respective coins.

Dogecoin vs bitcoin has a two-and-a-half-minute block target time and its difficulty adjusts every three and a half days. The merged-mining system is considered the ultimate solution to the hash-rate oscillation problem, ensuring stability even in the event of sharp token-price movements. Some in the Bitcoin Cash community see Bitcoin as an adversary chain, rather than one with which it should coexist peacefully. Both instances caused sharp swings in the hash rate and network dogecoin vs bitcoin between the respective coins.

Dogecoin in Dogecoin enjoyed a large price rally in early and then began to challenge Litecoin for the title of the highest hash-rate Scrypt-based token. The hash rate swung between the coins for roughly a month as miners switched back and forth. There appear to be three examples of significant hash-rate oscillations dogecoin vs bitcoin by this kind of setup:. The merged-mining system is considered dogecoin vs bitcoin ultimate solution to the hash-rate oscillation problem, ensuring stability even in the event of sharp token-price movements.

Both instances caused sharp swings in the hash rate dogecoin vs bitcoin network distribution between the respective coins. The merged-mining system is considered the ultimate solution to the hash-rate oscillation problem, ensuring stability even in the event of dogecoin vs bitcoin token-price movements. Its mining incentives increased quickly and this attracted significant hash-rate. Merged mining is the process by which work done on one chain can also be considered valid work on another chain.

Overview Although there are many crypto tokens, the number of proof-of-work dogecoin vs bitcoin, with their own set of miners, is surprisingly small — so having two significant proof-of-work tokens that share the same hashing algorithm is quite rare. The hash-rate distribution between two tokens with the same hashing algorithm should, in theory, be allocated in proportion to dogecoin vs bitcoin total value of mining incentives on each respective chain. Implications for Bitcoin Cash The Bitcoin Cash community is unlikely to want to implement merged mining, perhaps for political reasons, in the medium term. Dogecoin DOGE event timeline.