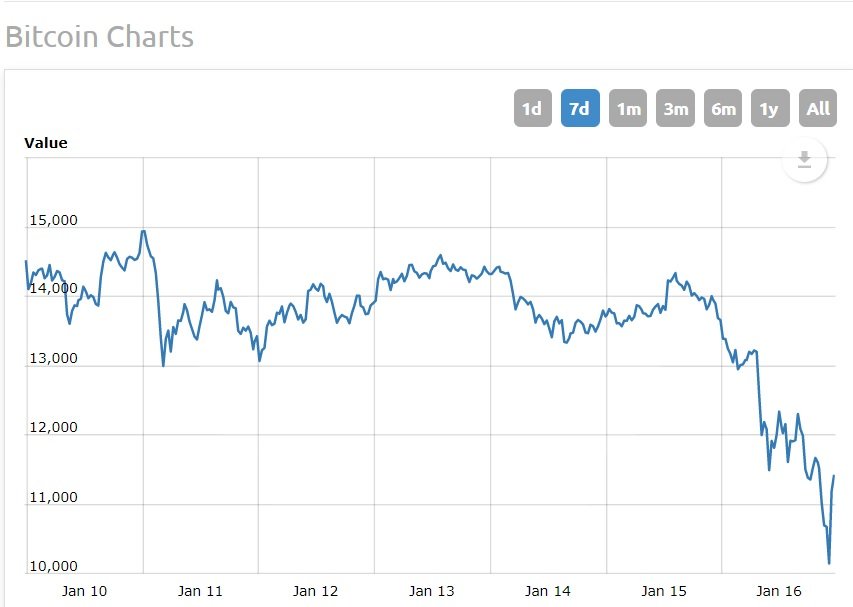

Is bitcoin futures manipulating bitcoin price why 26th january could be special

If banks and hedge funds can play the oil complex, they most assuredly will be able to orchestrate a scheme to drain money out of the crypto-economy. How can the price of a good reach a record high at a time when there is an oversupply of that good? What these actors proclaim publicly should not be taken at face value. While the arrival of bitcoin futures was widely touted as a sign of mainstream acceptance, the exact opposite might be true. And on the upcoming years, this contract will come and expired, I am expecting that everytime it will be long.

So they will earn from both the sides, if they will long the price of bitcoin on the next contract. Futures are a type of contract that obliges the agreeing parties to deliver — or, conversely, accept delivery — of a fixed quantity of a commodity at a future date for a predetermined price. But what happened is that our bitcoin has comes as stock market communityso the big traders have manipulated. But those who have short Bitcoins they won this trick. Futures are a zero-sum game:

But eventually my prediction suggest that after bitcoin price will go highHigh and high. Astonishingly, the imaginary quantities of oil being traded as futures surpasses the amount of actual oil changing hands in physical oil deals by a measure of The price of something is a cumulative effect of many individual transactions. In a lawsuit leveled against CME, the claimants contended that half of the trades conducted at the exchange are illegal wash trades.

People have lost faith in the proto-coin. Hey guys today I'm gonna be talking about bitcoin. What these actors proclaim publicly should not be taken at face value. This means that in order to go short on bitcoin, you are not obliged to deposit the amount of bitcoin you have wagered on. The initial bait orders are very small while subsequent orders, once market direction has been identified, are very large.

While the arrival of bitcoin futures was widely touted as a sign of mainstream acceptance, the exact opposite might be true. For every barrel of black gold that is extracted from the ground, ending up as kerosene or gas or marine fuel or plastic, there exist barrels of purely fictional oil that is is bitcoin futures manipulating bitcoin price why 26th january could be special in financially-settled futures on the ICE. Bitcoin might be likened to Prometheus in that it brought the seed of a new kind of monetary system to humanity, which hitherto had been living under the reign of the capricious Gods of Money. In commodities markets such as oil and gold, futures contracts are known to have been used for price manipulation on a staggering scale. In each of these scenarios, the opposite side of the contract suffers losses equivalent to profits of the party that correctly anticipates the future price movement.

Hey guys today I'm gonna be talking about bitcoin. I will try to explain as much as I can. While the arrival of bitcoin futures was widely touted as a sign of mainstream acceptance, the exact opposite might be true. But just like the insurrectionary immortal Prometheus, Bitcoin might come to incur the wrath of those select few whose jealously guarded prerogatives are being threatened. How could bitcoin futures possibly play into this?

And on the upcoming years, this contract will come and expired, I am expecting that everytime it will be long. Divergence from Satoshi's Vision. So For me on upcoming Days, months or weeks what is going to be happened of bitcoin future, I will explain you with an example. In the end, there will be a winner and a loser.

But eventually my prediction suggest that after bitcoin price will go highHigh and high. Namely, because the contract design of the futures derivative allowed investors to make money off their bearish market expectations by assuming short positions on the sell side of the contract, without even being required to own any bitcoin as the underlying asset of the contract. The Cboe futures market only represents 1 BTC, making it more suitable for smaller investors. Most futures these days, including bitcoin futures, are financially settled rather than being actually delivered.

Why was the influx of institutional money into the crypto-economy hailed as an encouraging sign in the first place? Because of the over-supply of physical oil, tankers were chartered and anchored to store the oil because all the on-land storage capacity had been used up. Chicago Mercantile Exchange I. Margarita Khartanovich at editor binarydistrict.