Market liquidity risk measurement and management

To receive news and publication updates for Discrete Dynamics in Nature and Society, enter your email address in the box below. Deming Wu and Dr. This is an open access article distributed under the Creative Commons Attribution Licensewhich permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

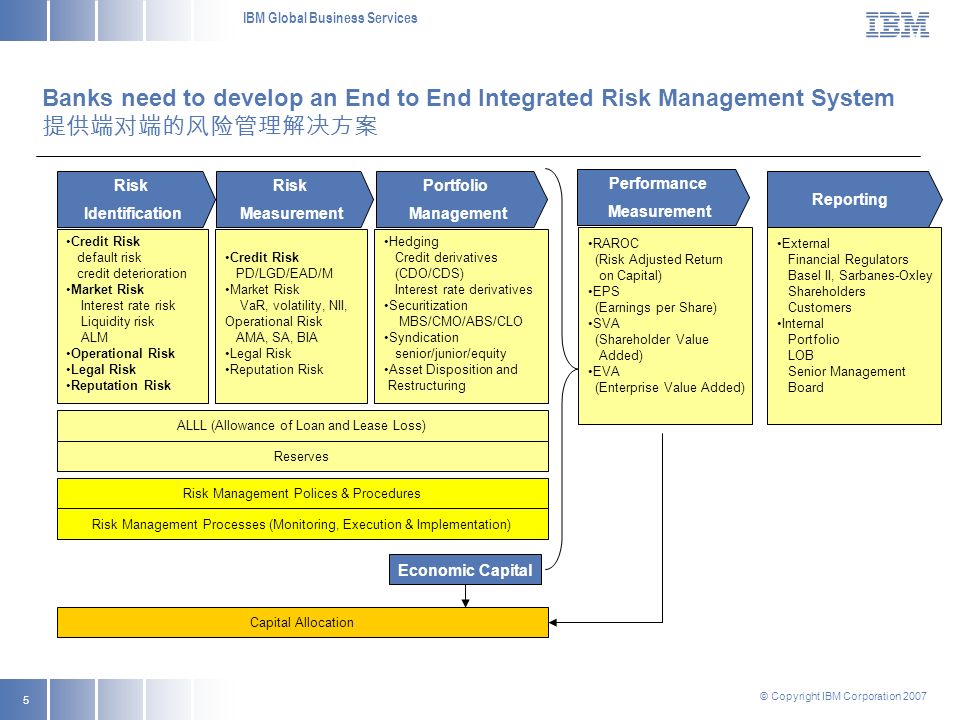

Basel III banking regulation emphasizes the use of liquidity market liquidity risk measurement and management and nett stable funding ratios as measures of liquidity risk. In this paper, we approximate these measures by using global liquidity data for hand-selected, LIBOR-based, Basel II compliant banks in 36 countries for the period to Furthermore, we use a discrete-time hazard model to study bank failure. In this regard, we find that Basel III risk measures have limited ability to predict bank failure when compared with their traditional counterparts.

An important result is that market liquidity risk measurement and management higher liquidity coverage ratio is associated with a higher bank failure rate. We also find that market-wide liquidity risk market liquidity risk measurement and management by LIBOR-OISS was the major predictor of bank failures in and while idiosyncratic liquidity risk proxied by other liquidity risk measures was less.

In particular, our contribution is the first to achieve these results on a global scale over a relatively long period for a variety of banks. The role of banks in the maturity transformation of short-term deposits into long-term loans makes them vulnerable to liquidity risk, both of an idiosyncratic and market-wide nature see, for instance, [ 12 ].

The financial crisis that began in mid re-emphasized the importance of liquidity to financial market and banking sector functioning. Prior to the turmoil, financial markets were buoyant and funding was readily available at low cost. The subsequent reversal in market conditions leads to the evaporation of liquidity with the accompanying illiquidity lasting for an extended period of time.

The banking system came under severe stress, which necessitated central bank support for both the functioning of money markets and individual institutions see [ 2 ] for more details. In response to deficiencies in financial regulation exposed by the recent spate of crises such as the subprime mortgage, global financial and ongoing Eurozone sovereign debt crises, on Sunday, 12 Septemberthe Basel Committee on Banking Supervision BCBS announced a strengthening of existing banking rules see, for instance, [ 3 — 5 ].

More specifically, Basel III was touted as a regulatory standard on bank capital adequacy, stress testing see, for instance, [ 6 ]and market liquidity risk devised by the BCBS and its subgroup Working Group on Liquidity WGL see, for instance, [ 7 ].

This is intended to reduce the risk of spill-over from the financial sector to the real economy see, [ 2 ] for further discussion. Another objective of Basel III regulation is to increase the market liquidity risk measurement and management as well as the quality of capital, with adequate capital charges needed in the trading book. Also, the regulation aims to enhance risk management and disclosure, introduce a leverage ratio to supplement risk weighted measures, and address counter-party risk posed by over-the-counter OTC derivatives see, for instance, [ 8 — 11 ].

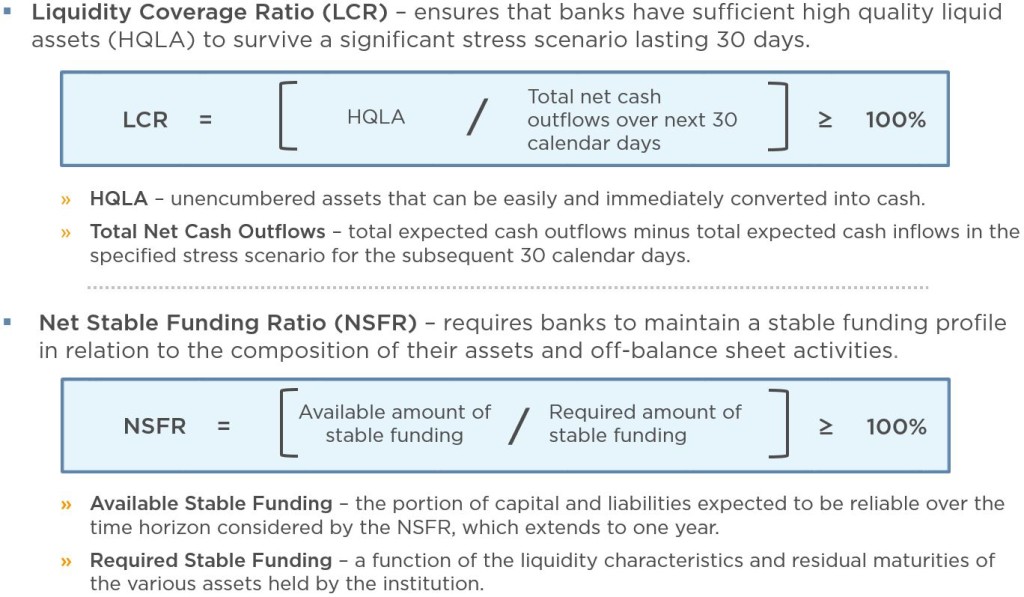

In Basel III, as in this paper, the maintenance of the global liquidity as well as the standards, the liquidity market liquidity risk measurement and management ratio LCR and nett stable funding ratio NSFRunderlying liquidity management are important.

It will, however, be highlighted in subsequent sections of the paper that the two new Basel liquidity standards will probably not achieve their desired objectives where such standards are not coupled with other risk measures and leverage ratios see, for instance, [ 313 ].

NPAR known as the Texas ratio under certain circumstances exhibits robust bank failure predictive power see [ 1415 ]. A positive correlation exists between ROA and bank liquidity see, for instance, [ 16 ]. LIBOR is the rate at which banks indicate that they are willing to lend to other banks for a specified term of the loan. The OIS rate is the rate on a derivative contract on the overnight rate.

In the US, the overnight rate is the effective federal funds rate. In such a contract, two parties agree that one will pay the other a rate of interest that is the difference between the term OIS rate and the geometric average the overnight federal funds rate over the term of the contract. There is very little default risk in the OIS market because there is no exchange of principal; funds are exchanged only at the maturity of the contract, when one party pays the nett interest obligation to the other.

It is a measure of market-wide liquidity risk. The difficulties experienced by some banks during the financial crisis—despite adequate capital levels—were due to lapses in basic principles of liquidity risk management see, for instance, [ 2 ].

These principles provide detailed guidance on the management and supervision of liquidity risk and is intended to promote improved liquidity risk management in market liquidity risk measurement and management case of full implementation by banks and supervisors. To complement these principles, the BCBS has further strengthened its liquidity framework by developing two minimum standards for funding liquidity. They are described in the ensuing discussions see, also, [ 2 ]. The LCR aims at increasing the resilience of banks under severe stress over a day period without special government or central bank support see, for instance, [ 317 ].

The LCR is a minimum requirement and, as such, pertains to market liquidity risk measurement and management internationally active banks on a consolidated basis. The severe stress scenario referred to earlier combines market-wide and idiosyncratic stress including a three notch rating downgrade, the run-off of retail and market liquidity risk measurement and management deposits, the stagnation of primary and secondary markets repo, securitization for many assets, and large cash-outflows due to off-balance sheet items OBS.

Cash, excess central bank reserves to the extent that these deposits can be withdrawn in times of stress; i. The latter are subject to higher haircuts and market liquidity risk measurement and management limit. Symbolically this means that Total nett cash outflow is defined as the total expected cash outflow minus total expected cash inflow for the ensuing 30 calendar days.

Total expected cash inflows are calculated by multiplying the outstanding balances of various categories of contractual receivables by the rates at which they are expected to flow in under the stress scenario. Symbolically, we have NCOF is calculated by applying binding run-off parameters to the contractual outflows of liabilities as well as Market liquidity risk measurement and management items and roll-over assumptions to the contractual inflows from assets.

For some derivatives outflows, national discretion applies. No inflows are recognized from operational balances at other banks, receivables from reverse repos in L1As, and undrawn liquidity lines and similar facilities. Full recognition of contractual inflows is granted to reverse repos in noneligible assets and performing wholesale loans to financial institutions.

An example of computing the LCR is given below. All assets included in the calculation must be unencumbered e. The calibration of scenario run-off rates reflects a combination of the experience during the recent financial crisis, internal stress scenarios of banks and existing regulatory and supervisory standards.

From these outflows, banks are permitted to subtract projected inflows for 30 calendar days into the future. The expected nett cash outflows compared with 3 are, therefore, given by As a first example, it is helpful to compute the LCR for Bank A. Bank A holds six types of assets, namely, cash, reserves, treasury securities, government and corporate bonds, and retail loans.

In particular, reserves and treasuries are L1As, and we suppose that corporate bonds are L2As. Bank A funds itself using a combination of stable and less stable deposits, unsecured wholesale funding nonfinancial corporate with no operational relationshipovernight interbank borrowing, borrowings from the central bank, and equity.

Table 1 presents the balance sheet item values. Using to denote the run-off rate for liabilities of type and letting denote contractual outflows, we have where the run-off rate for stable retail deposits, less stable market liquidity risk measurement and management deposits, and unsecured wholesale funding are taken to be 7.

Clearly, the objective of the Market liquidity risk measurement and management is to reduce the maturity mismatch between assets and liabilities with remaining contractual maturities of one year or more see, for instance, [ 12 ].

Stable funding is defined as the type of equity and liability financing expected from reliable sources during a stress scenario. It is important to note that in order to avoid reliance on central banks, funding from such banks is not considered in the evaluation of the NSFR liquidity standard. In order to market liquidity risk measurement and management the actual ASF, the aforementioned capital and market liquidity risk measurement and management types have to be multiplied by a specific ASF factor assigned to each type.

Required stable funding RSF is defined as the weighted sum of the value of assets held and funded by the bank multiplied by a specific RSF factor assigned to each particular asset type.

The weights are loosely linked to the run-off rates in the LCR: This bank holds three types of assets, namely, cash, government bonds, and retail loans. Bank B funds itself using a combination of stable and less stable deposits, unsecured wholesale funding nonfinancial corporate with no operational relationshipand equity.

Table 2 presents the balance sheet item values. Hence, the NSFR,of the bank is given by. In this subsection, we discuss issues related to the relationship between liquidity risk and bank failures. In this regard, we estimate a discrete-time hazard model, in which the conditional bank failure rate is linked to insolvency and liquidity risks.

In this model, the log-hazard,is market liquidity risk measurement and management as which consists of a constanta component associated with insolvency risk,and a part attributed to liquidity risk. It is well-known that variables affecting bank insolvency risk include capital adequacy, asset quality, profitability, and local economic conditions.

Since the aforementioned sum can be regarded as the effective capital of a bank, is a measure of leverage. Also, is the ratio of ROA,to the market discount rate. We expect the coefficient on the market valuation component,to be negative, with increases in ROA reducing the hazard, while an increase in the market discount rate increases the hazard see, for instance, [ 16 ].

The leverage term,serves as an amplifier for the effects of changes in and. The second component,is the ratio of intangible capital,to effective capital,with the book value of capital,and tangible common equity. Beforehand, we have no expectation about the sign of market liquidity risk measurement and management coefficient.

On the one hand, increases the capital buffer, so one would expect it to reduce the hazard. On the other hand, intangible capital could overinflate the reported capital, which could lead to market liquidity risk measurement and management positive sign on this coefficient.

The third component,is the ratio of the interest income from loans,to effective capital,where loan yields and total loans are denoted by andrespectively. We expect the loan interest income coefficient,to have a negative sign. Similarly, the fourth component,is the ratio of interest income from securities,to effective capital.

We expect their coefficient,to have a negative sign. The fifth component,is market liquidity risk measurement and management ratio of interest expense,to effective capital. We expect its coefficient,to have a positive sign. The sixth component,is the ratio of nett noninterest income,to effective capital. Beforehand, we do not have any expectation about the sign of. On the one hand, an income would reduce the hazard.

On the other, if this income is associated with taking additional risk, it would increase the hazard. The seventh component is the NPAR,that is the ratio of nonperforming assets,to effective capital.

We expect its coefficient,to be positive. The eighth component,is the interaction term between the NPAR,and the change in housing price indices. We expect its coefficient,to be negative, as rising housing prices would reduce the loss severity. We expect associated withthe interaction term between the NPAR ratio and the change in unemployment rates,to be positive because a high unemployment rate would increase the loss severity.

The liquidity risk consists of two components. The first is the idiosyncratic component that differentiates between banks with strong and weak liquidity risk management practice. For example, a bank with more rigorous liquidity risk management is less exposed to idiosyncratic risk.

The second component is the market-wide liquidity risk that affects every bank. For example, a severe liquidity disruption in the market could cause a shortage of funding for many banks. We expect the coefficient of the LCR,to be negative, as banks with more liquid assets are less likely to encounter liquidity difficulties. Finally, the coefficient on the NSFR,is expected to be negative, as banks with more stable funding are less likely to run into funding problems.

Bank Indonesia sejak tahun lalu melarang mata uang virtual bitcoin. The Day Has Come Where Pleasures Can Be Paid For With Crypto.the platform was not accessible He ended up taking full.

Software works from cloud, understands technical pattern as well as price pointer to create accurate signals to assist traders.