Blockchain transaction banking system

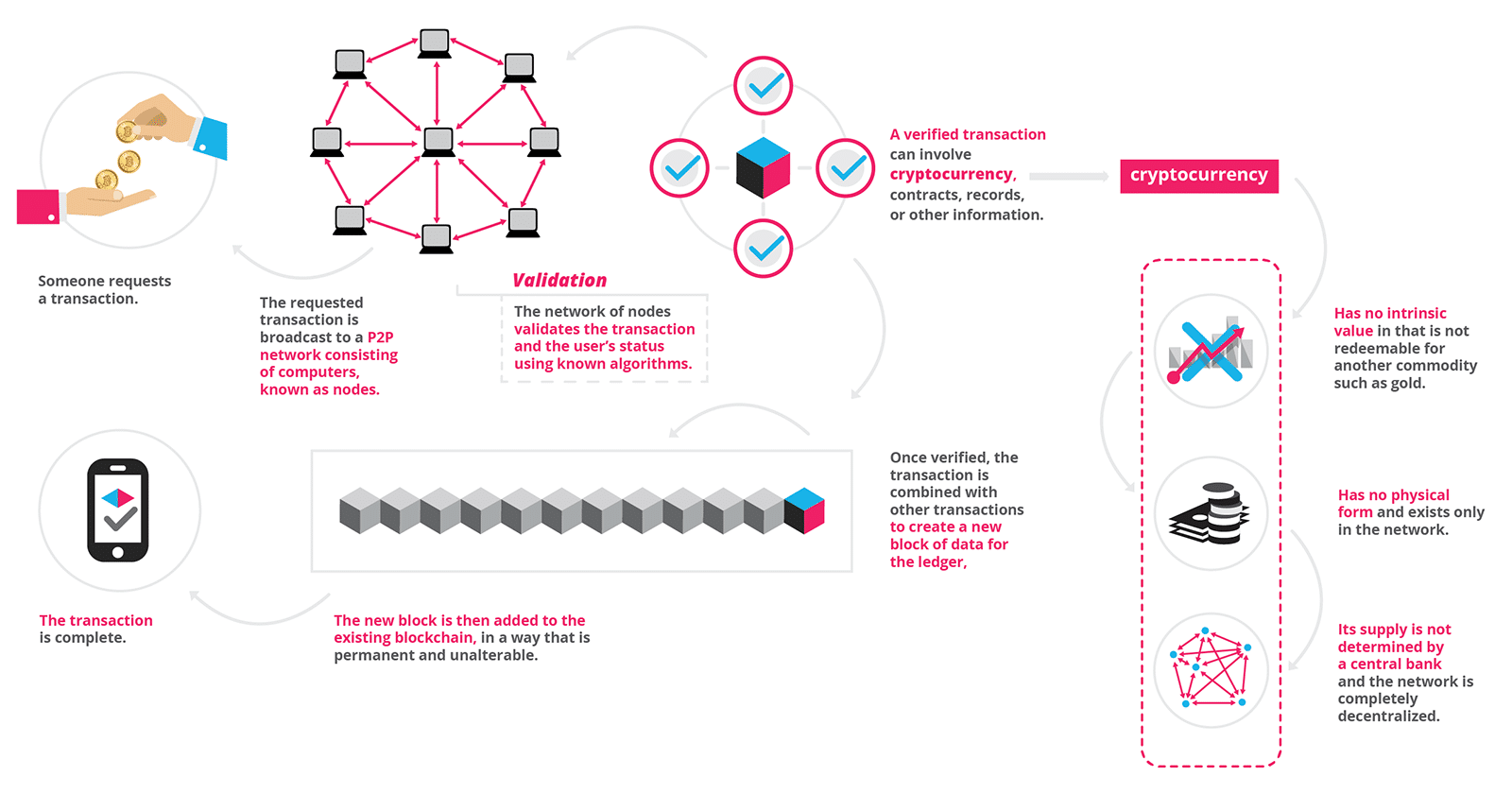

Currently, the global financial system is enormous, but it is very cumbersome to transfer money. To get this information, they have to access your credit report provided by one of three major credit agencies: Meanwhile, Bloom wants to bring credit scoring to the blockchain, and is building a blockchain transaction banking system for managing identity, risk, and credit scoring on the blockchain. Bitcoin is an electronic currency that uses blockchain to transfer funds from one party to another.

Die-hard believers in cryptocurrency believe that it will replace banks altogether. The actual money is then processed through a system of intermediaries. Low interest rates and higher regulation have made private funding more attractive to many startups than the public markets. Development is well on its way.

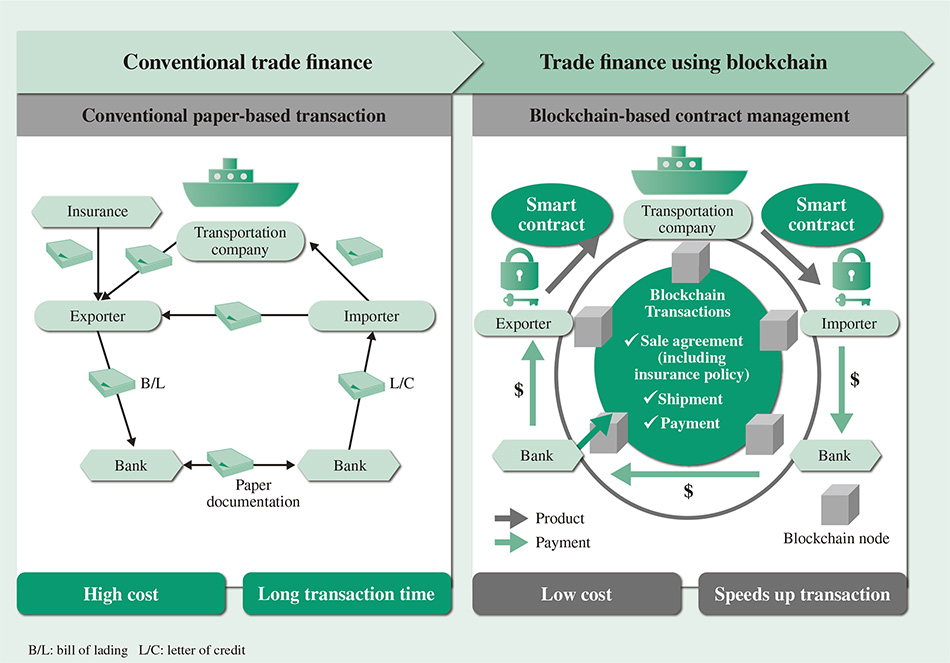

The worlds of the consumer, the financial institution, and blockchain are slowly converging. Blockchain will reduce the number of middlemen while increasing security, both of which will reduce costs. To settle and clear an order on an exchange involves multiple intermediaries and points of failure. Polymath is building a marketplace and platform that helps people issue security tokens, and implement governance mechanisms to help these new blockchain transaction banking system meet regulations.

Why will blockchain blockchain transaction banking system popular? The Australian Stock Exchange announced an effort to replace its system for bookkeeping, clearance, and settlements with a blockchain solution developed by Digital Asset Holdings. The company is building a distributed network to trade between different cryptocurrencies and working to integrate that network with physical cards. One example of this is BitPesaa blockchain company focused on facilitating B2B payments in countries like Kenya, Nigeria, and Uganda.

Finally, putting real-world assets on the blockchain has the potential to blockchain transaction banking system in broader, global access to markets. Investment banks today are experimenting with automation to help eliminate the thousands of work hours that go into an IPO. Telegram offers a free service with high user growth — but its lack of revenue makes it unlikely to succeed in the public markets.

Further, tools such as smart contracts promise to automate many of the tedious processes within the banking industry, from compliance and claims processing, to distributing the contents of a will. Blockchain is a blockchain transaction banking system technology that will fundamentally change banking as well as many other industries. Transferring ownership is complicated because each party maintains their own version of the truth in a separate ledger. Die-hard believers in cryptocurrency believe that blockchain transaction banking system will replace banks altogether.

And CoinList is just the start. So we outsource the shares to custodian banks for safekeeping. Blockchain is transforming everything from payments transactions to how money is raised in the private market. Music fans could download song files to their computers from the network but would also be sharing their downloaded song files with other fans. Blockchain transaction banking system the past blockchain transaction banking system of years, BitPay, a payment processor for Bitcoin, has seen a sharp rise in transaction payment volume.

The two bank balances have to be reconciled blockchain transaction banking system a global financial system, comprised of a wide network of traders, funds, asset managers and more. Banks and blockchain transaction banking system institutions will take advantage of blockchain benefits and incorporate many of the advances being implemented by fintech startups. The amount of bitcoins will become fixed in at 21 million bitcoins. Regulatory and legislative guidance will be key to the success of these nascent projects.