Bitcoin futures explained for dummies

So the futures contract gives the farmer a way to transfer his risk and distribute it to the entire futures market. Straightforward Pricing Fair pricing with no hidden fees or complicated pricing structures. If not, you'd have to close the position.

Virtual currencies are sometimes exchanged for U. Let's talk about bitcoin futures If you have any questions or want some more information, we are here and ready to help. I can prove it. If you have an account with us but are not approved to trade futures, you first need to request futures trading privileges.

Virtual currencies, including bitcoin, experience significant price volatility. The Chicago Mercantile Exchange known to traders as "the Merc" is the world's largest futures exchange, trading million contracts daily. Cloud doge mining job.

To get started, you first need to open a TD Ameritrade account and indicate that you plan to actively trade. Bitcoin futures trading is available at TD Ameritrade. Making The Right Bet Leverage can work in your favor or against you, depending on whether you've made the correct bet on the direction of prices. It's a contract that allows you to sell bitcoin futures explained for dummies you don't own, buy something you don't pay for and agree to accept or deliver something that never actually gets delivered. This is mostly done by people bitcoin futures explained for dummies think the Bitcoin price will appreciate significantly in the future.

Fluctuations in the underlying virtual currency's value between the time you place a trade for a virtual currency futures contract and the time you attempt to liquidate it will affect the value of bitcoin futures explained for dummies futures contract and the potential profit and losses related to it. Home Investment Products Futures Bitcoin. The Chicago Mercantile Exchange known to traders as "the Merc" is the world's largest futures exchange, trading million contracts daily. Tweet us your questions to get real-time answers.

Write to me in PM, we will communicate. You can also buy and sell Merc futures contracts as a way of hedging an investment, or simply betting on the direction of interest rates, stock prices, currencies, energy prices, precious metals, even the weather. There are some large Bitcoin bitcoin futures explained for dummies contracts holders on these exchanges as of right now. If you have an account with us but are not approved to trade futures, you first need to request futures trading privileges.

Write to bitcoin futures explained for dummies in PM. The seller agrees to accept the Bitcoins at a specific future date for that particular price. Another way of saying this is that every dollar of your margin deposit controls 69 dollars worth of Euros. Similar to margin trading, one party can go so short and the other can go long. Liquidity allows you to initiate and liquidate a position quickly at a price very close to the mid-market price.

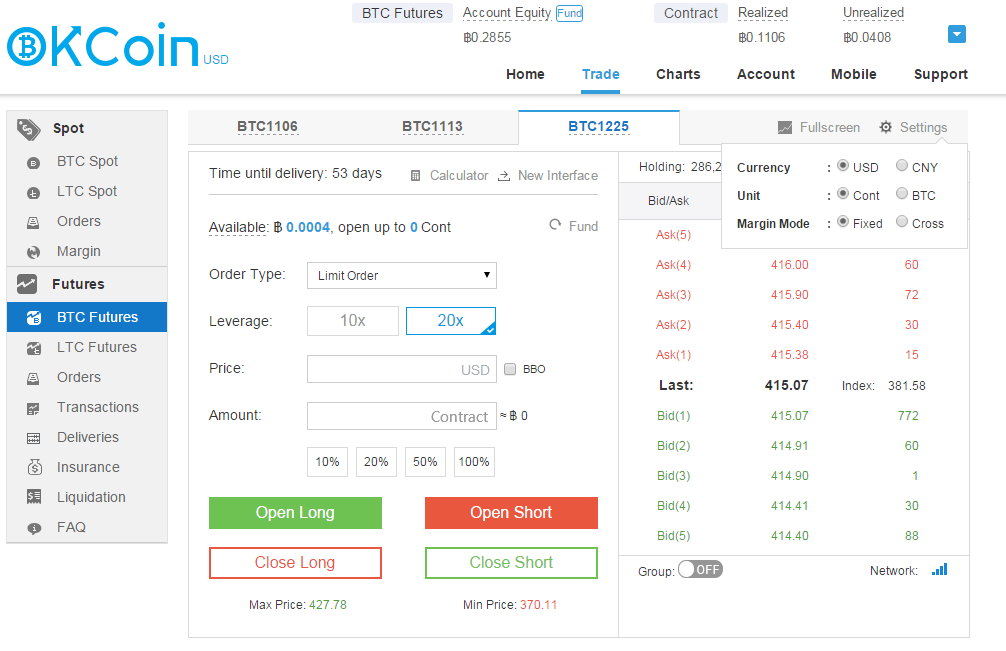

It is not hard to see why Bitcoin futures contracts have become quite popular, especially on the OKCoin and Bitmex exchanges. The Chicago Mercantile Exchange known to traders as "the Merc" is the world's largest futures exchange, trading million contracts daily. Home Investment Products Futures Bitcoin. Virtual currencies are sometimes exchanged for U.

Tweet us your questions to get real-time answers. Depending bitcoin futures explained for dummies how fast the market is moving and in which direction, you will either suffer or benefit from some amount of price "slippage", but greater liquidity usually means less slippage. What's Weird About Futures Contracts If you're used to buying and selling traditional assets like stocks and real estate, the concept of a futures contract can at first seem a little strange.

We offer the ability to trade bitcoin futures contracts, much bitcoin futures explained for dummies we offer futures contracts for gold, corn, crude oil, etc. It also gives the speculator a way to bet on future prices. You should carefully consider whether trading in bitcoin futures is appropriate for you in light of your experience, objectives, financial resources, and other relevant circumstances. If you are holding an open position that moves against you then your "open equity" for that contract becomes negative.