Swift blockchain vs ripple

Just on Wednesday Ripple announced, that they could get another 10 banks to work with them, which brings the total number up to 75 banks trying the possibilities and opportunities this new Technology got to offer. By bringing the In case Ripple succeeds the banks would more or less bypass their own traditional system and bring it on the Blockchain instead.

Organizations like Swift, one of the main guardians of the current banking model would be outdated and potentially useless for the whole industry in the end. But there will for sure be more and more banks joining the Ripple Network as it already includes some big Players like Santander or Standard Chartered. With Ripple being publicly available it might maybe as well be used by Business or People directly and officially without any banks being involved Ripple might most probably be the one CryptoCurrency with the most varied views and opinions.

Or why might anyone like to stick to a bank, whenever he could handle it on his own with the same save Tools? But my nervousness about ripple is that I'd rather hold the equity than the currency xrp. It is clear to me Ripple looks like being able to take loads of cost out of the finance sector and many will adopt it.

But it can do this with its core technology to which xrp is an optional additional solution with extra benefits. I would like to see more people distinguishing between banks and swift use of the ripple technology vs xrp.

I asked ripple outright at a conference if it was true ripple the company and its equity could be successful without xrp being successful and they confirmed this. Two banks I spoke to at another conference said they'd use ripple the tech but not xrp. Do your own due diligence everyone. I'm not saying xrp won't be successful.

Just that the news I usually see always seems too cloudy about what is being trialled and what is being adopted. Thanks a lot for this great Input katythompson. There's definitely a truth about the underlying technology being more important to the finance sector. XVia is the tool through which businesses connect to RippleNet to send payments.

XRapid is the instrument by which XRP liquidity can be offered to those interested. In October of this year, Ripple announced: Bank to accelerate your use of this program. We will pay you in XRP. This is the answer given by Brad Garlinghouse, CEO of Ripple to a reporter who has asked him how he will convince banks to use the XRP currency in cross-border payments. The fund will also use XRP for all distributions and fees. Through its technology, Ripple has revolutionized cross-border money transfers.

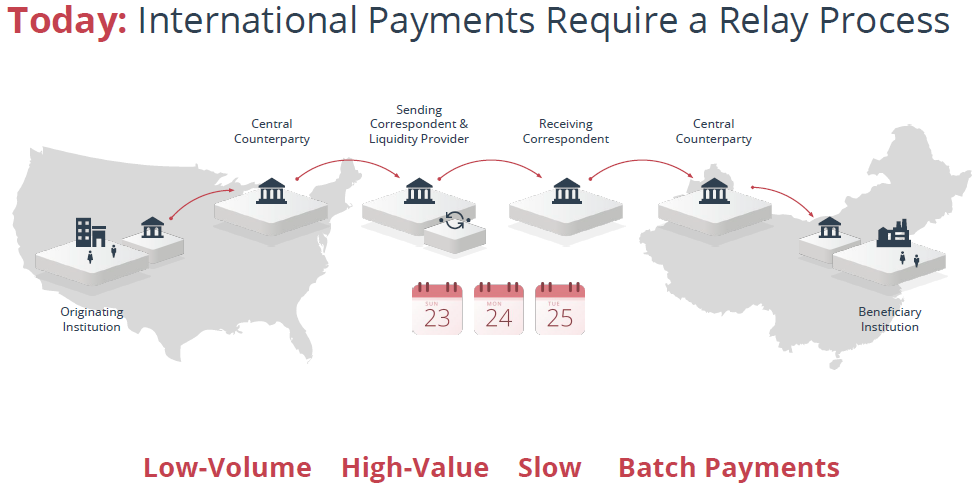

Also, the most important aspect is to reduce the time that a money transfer used to take. Currently, through SWIFT and the outdated chain of correspondent banks, a cross-border money transfer takes between 3 and 5 days.

Through Ripple technology and the XRP, a cross-border money transfer will take place within 4 seconds. Financial messages are used to facilitate cross-border money transfers. The company currently has about 2, employees. SWIFT carries financial messages but does not hold accounts for its members and does not make any form of clearing or settlement.

SWIFT does not facilitate funds transfer: Each financial institution, to exchange banking transactions, must have a banking relationship by either being a bank or affiliating itself with one or more so as to enjoy those particular business features. SWIFT has become the industry standard for syntax in financial messages. It was not the first such attempt, the society acknowledged, and the security of the transfer system was undergoing new examination accordingly.

Soon after the reports of the theft from the Bangladesh central bank, a second, apparently related, attack was reported to have occurred on a commercial bank in Vietnam. Using the current SWIFT messaging system and banking correspondence, which is the backbone of the old cross-border payments, the GPII is essentially a set of rules that obliges banks to behave more rationally in cross-border payments, supported by tracking payments and data to monitor their compliance with new rules.

However, as you will see in the conclusions of this article, GPII is far from being a real competitor for Ripple. I see many enthusiasts on various websites that already see Ripple managing these colossal sums. I say we are more realistic. The road that Ripple goes through is not easy. I say just as much: The employees team at Ripple is very efficient.

If he did not have an efficient team, Ripple would not be in this final stage of development. The fact that Ripple has convinced over banks to test their technology proves this. There will be a battle between traditionalism and the new blockchain technology. The war of conquering this huge market will be tough and will last for years. No doubt the blockchain technology will be imposed.

Ripple and XRP will slowly but surely win a slice of this huge cross-border transfer market. I think the year will be an important year in the development and use of the XRP as the buffer currency in cross-border payments.