Intraday liquidity bcbs of alabama

The BIS hosts nine international organisations engaged in standard setting and the pursuit of financial stability through the Basel Process.

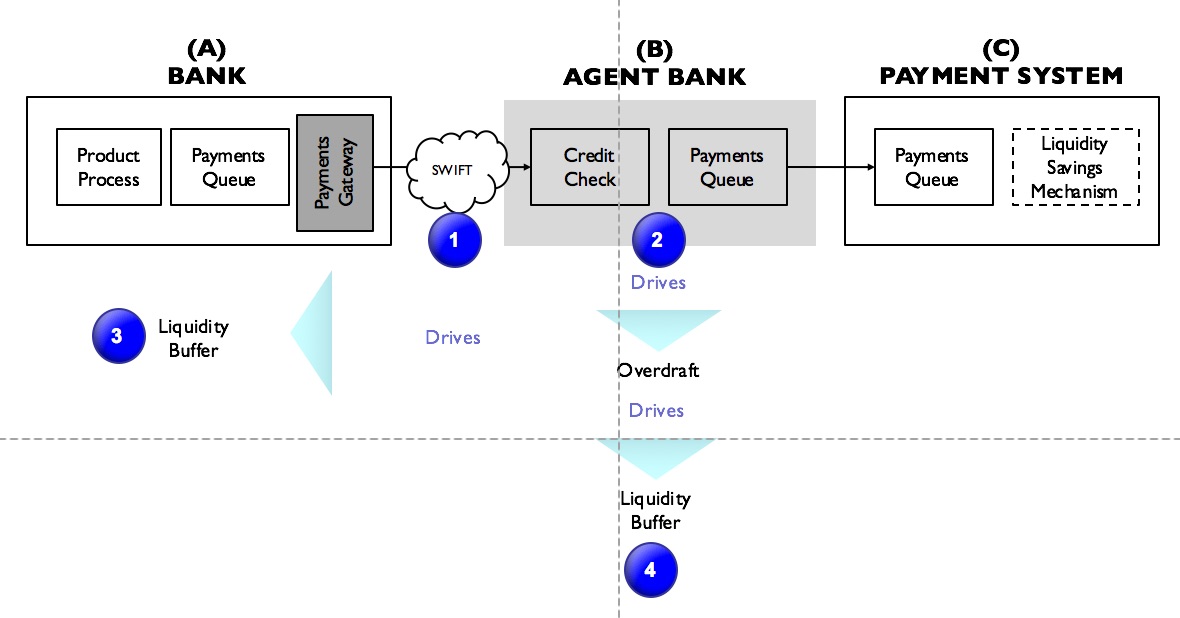

This document is the final version of the Committee's Monitoring tools for intraday liquidity management. It was developed in consultation with the Committee on Payment and Settlement Systems to enable banking supervisors to better monitor intraday liquidity bcbs of alabama bank's management of intraday liquidity risk and its ability to meet payment and settlement obligations on a timely basis.

Over time, the tools will also provide supervisors with a better understanding of banks' payment and settlement behaviour. Management of intraday liquidity risk forms a key element of a bank's overall liquidity risk management framework. As such, the set of seven quantitative monitoring tools will complement the qualitative guidance on intraday liquidity management set out in the Basel Committee's Principles for Sound Liquidity Risk Management and Supervision.

It is important to note that the tools are being introduced for monitoring purposes only and that internationally active banks will be required to apply them.

National supervisors will determine the extent to which the tools apply to non-internationally active banks within their jurisdictions. The Liquidity Coverage Ratio and liquidity risk monitoring tools Januaryintraday liquidity bcbs of alabama sets out one of the Committee's key reforms to strengthen global liquidity regulations does not include intraday liquidity within its calibration. The reporting of the monitoring tools will commence on a monthly basis from 1 January to coincide with intraday liquidity bcbs of alabama implementation of the LCR reporting requirements.

Intraday liquidity bcbs of alabama earlier version of the framework of monitoring tools was intraday liquidity bcbs of alabama for consultation in July The Committee wishes to thank those who provided feedback and comments as these were instrumental in revising and finalising the monitoring tools.

This website requires javascript for proper use. About BIS The BIS's mission is to serve central banks in their pursuit of monetary and financial stability, to foster international cooperation in those areas and to act as a bank for central banks.

Read more about the BIS. Central bank hub The BIS facilitates dialogue, collaboration and information-sharing among central banks and other authorities that are responsible for promoting financial stability.

Read more about our central bank hub. Statistics BIS statistics on the international financial system shed light on issues related to global financial stability.

Read more about our statistics. Banking services The BIS offers a wide range of financial services to central banks and other official monetary authorities. Read more about our banking services. Visit the media centre. Monitoring tools for intraday liquidity management Summary of document history. Previous version Previous consultation This version Subsequent consultation Subsequent version.

Monitoring indicators for intraday liquidity management - consultative document. Related information Press release: Framework on monitoring tools for intraday liquidity management issued by the Basel Committee. Top Share this page.