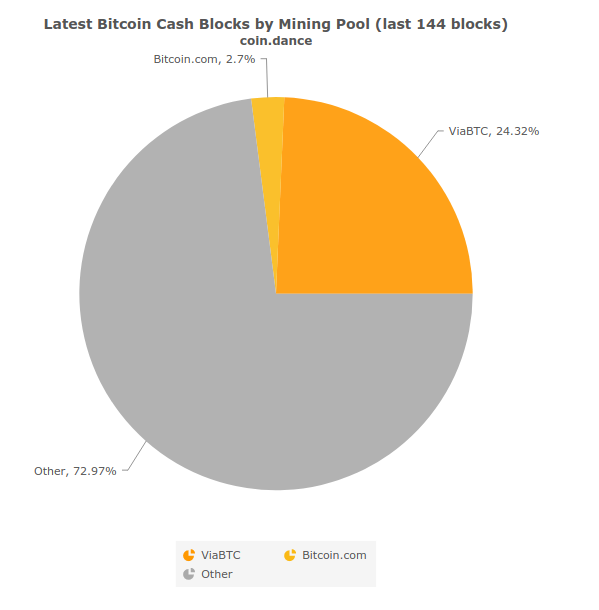

Hashrate distribution bitcoin cash

Illustration of hashrate oscillation dynamics — Increase in the price of Bitcoin Cash. The above model is an over simplification and excludes several other stages of hashrate oscillations.

The table assumes hashrate is distributed according the relative price levels of the two coins. Transaction fee dynamics are excluded. The above illustrates that the Bitcoin chain could experience block interval swings for longer periods than Bitcoin Cash, due to the longer difficulty adjustment window.

However, the data also shows that even a large fluctuation in the price of Bitcoin Cash, from 0. These slower blocks may generate some additional transaction congestion on the Bitcoin chain. Although, somewhat ironically, this particular problem is likely to be of greater concern to Bitcoin Cash supporters than a Bitcoin supporters.

Many long term Bitcoin holders may not be concerned by periods of Although this may be disruptive to users in the medium term, in our view, it is unlikely Bitcoin Cash will maintain such high levels of price volatility for extended periods of time.

Therefore the above problem may not be a serious concern. However, it is possible that price volatility and therefore hashrate oscillations could remain for extended periods of time. If this is the case, although Bitcoin may deviate from 10 minute intervals for longer periods, the magnitude of the deviation could be larger for Bitcoin Cash.

This could therefore impact both coins in a negative way. Should this occur, the eventual Nash equilibrium end game solution could be merged mining, as we discussed in the previous piece. Although due to the current confrontational political climate, reaching such a solution could take a considerable amount of time and reconciliation. There may be some small elements within the Bitcoin Cash community who wish to disrupt the Bitcoin network.

For example, some people may have attempted to combine the timing of a rally in the price of Bitcoin Cash with a sharp downward difficulty adjustment caused by the EDA, to drive miners to Bitcoin Cash and disrupt the Bitcoin network. If the plan is to cause this kind of disruption, one potential idea could be to increase the difficulty adjustment period, for example to a two month window form a one day rolling period.

This would mean that following a sharp price rally of Bitcoin Cash, the difficulty of Bitcoin Cash would take longer to adjust than Bitcoin. Therefore Bitcoin Cash could remain more profitable than Bitcoin for longer periods, potentially causing disruption and transaction congestion on the Bitcoin network.

However, a long difficulty adjustment window like this may contradict the Bitcoin Cash philosophy. A shorter difficulty adjustment period, larger blocks and lower block times improve usability, which is a key focus of Bitcoin Cash. In contrast, longer difficulty adjustment periods, smaller blocks and longer block intervals, may improve resilience, which appears to be a key priority for the Bitcoin community.

Therefore Bitcoin Cash is unlikely to adopt such a policy, in our view. BCH miners were essentially mining at a loss, either for ideological reasons or on speculation that the bitcoin cash price would rise enough for them to sell the coins at profit. Once bitcoin cash had surpassed the parity threshold, hashpower began to pour into the BCH network. By August 21, major mining pools such as AntPool had begun mining bitcoin cash, enabling its network to claim more than one-third of the total hashpower.

The introduction of new miners has provided bitcoin cash with a much more even block distribution. The timing could just be a coincidence, but it is likely that the increase in hashpower helped convince them to add support for bitcoin cash. This rapid shift in hashpower has caused the bitcoin mempool to swell to a near-record level of 96MB May brought a mempool spike of nearly MB.

Unfortunately for bitcoin cash, this new status quo will not last. Due to the spike in hashpower, blocks are being found way too quickly. At the current pace, a block is being mined almost every minute. Most blocks are carrying very few transactions, and a significant number are smaller than 1KB.