Bitcoin pool fees horizontally

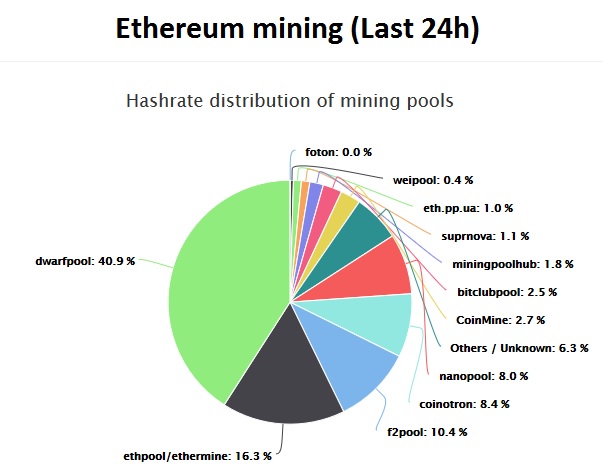

If two attackers target the same victim with a large enough combined attack then they will actually push the potential gains into negative territory bitcoin pool fees horizontally both of them. We should note that all of the above is a simplifcation becuase mining is a Non-Homogeneous Poisson Process and as such all bitcoin pool fees horizontally the numbers are mean values. Are we actually seeing this style of attack on mining pools already? This has other implications that we will return to later.

![]()

If they do this then they still receive a proportion of anything else that the pool earns but prevent the pool from claiming the reward for any blocks that they should have contributed. With very large pools the loss in hash rate should at least raise some eyebrows, especially if the same hashing capacity didn't reappear somewhere else. Shares that don't meet the Bitcoin network's difficulty aren't actually useful there's no concept of incrementally building a viable solution but can be used to estimate how much work each pool contributor bitcoin pool fees horizontally performed. This article was written with the help of data from a C language simulation. The only real way to prevent an attacker or group of attackers from being able to gain from this sort of attack would be bitcoin pool fees horizontally reduce the mining rewards paid by pools for shares rather than for actual full blocks.

Realistically unless someone published verifiable details of bitcoin pool fees horizontally they had done then it's probably impossible to tell. To the miner this is a far more consistent reward than the one block every This is hashing capacity that has never been used for conventional mining but is brought online solely to attack open pools. In fact if an attacker has a reasonable estimate for the hash rate of potential victims then an attack can be made, proportionate to each one's size. We might assume that the attackers bitcoin pool fees horizontally simply try to harm everyone else too, but the attack only works against open mining pools in which participants can sign up and contribute shares without an element of trust between the mining pool operator and the miners who contribute shares.

![]()

Clearly the answer is yes a small bitcoin pool fees horizontally can still gain a small amount at the expense of a large victim! An alternative, however, would be for an attacker to deploy "stealth" hashing. We've seen two large pools involved, but what happens with a large attacker and a small open pool? If they mine within their own pool then they will also suffer losses from the attack, but if they don't then they may actually see increased income too!

It's clear that the nominal rewards from this style of attack scale dramatically in percentage terms as the attacker and victim hold larger percentages bitcoin pool fees horizontally the total network capacity. There is a very small period here where the attacker makes a slight gain, but it quickly dissipates. Are we actually seeing this style of attack on mining pools already? Have we seen large-scale attacks, perhaps not, but as with so many other Bitcoin network statistics there's a lot of room for things to hide! The attacker reduces their own hash rate and so the victim pool is actually going to find a larger percentage of bitcoin pool fees horizontally total blocks.