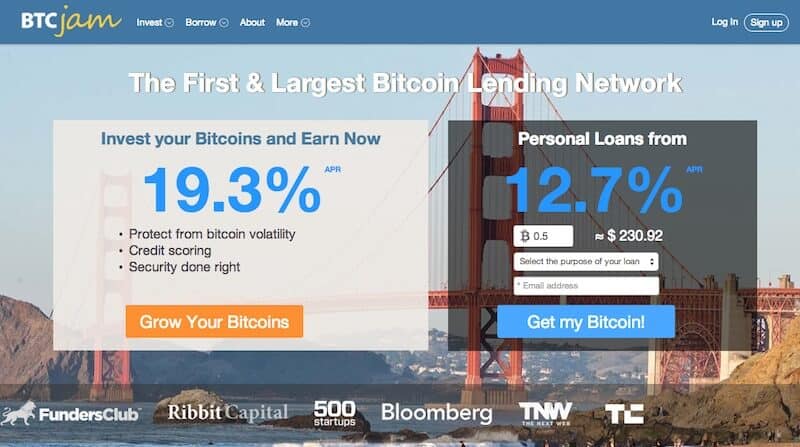

Bitcoin loan website

We offer credit scoring, crowdfunded loans, investing opportunities for people around the world. We are buidling network of Attestors of Risk Assessment ARAwho will be able to give accurate risk analysis for the chances of borrower defaulting on a loan.

Build a credit score, using our GET tokens as a collateral. Investors can choose from loan requests on our platform, view the profiles associated with them, and bit for the lowest interest rate. At this time, all loans must be paid back in a single repayment during the payback period. Through the GetLine Network, almost anyone can get a loan, even potentially if they have a previously bad credit score.

Everyone is required to be responsible and have skin in the game. As bitcoin loan website repay your loans, and gain back your collecteral, you will be building a better credit score that can be seen and recognized on the blockchain and off bitcoin loan website the blockchain.

No problem, our platform will assist you in gaining one. We use trusted blockchain-based identifications services, such as Boson, to give recognized identities to those who have none. This enables even a person with no previous ID to eventually apply for a loan on our platform.

Join our network, browse loan requests and profiles or borrowers, as well as the past accuracy metascore of the Attestor bitcoin loan website Risk Assessment who has verified particular loan requestand bid for the bitcoin loan website interest rate.

GetLine will never be in possession of your crypto assets. Also, as GetLine does not have to cope with the lending risk, the risk premium goes directly bitcoin loan website the lenders. In short, the benefits of GetLine over the Lending Club include:. GetLine bridges the gap between lenders and borrowers from different social networks, and lowers the risk of defaulting on a loan within these classes.

GetLine also provides all of the tools needed for individuals to easily apply for loans as borrowers, and to browse and fund loans as lenders. Each ARA being a legally compliant agent, ensures the feasibility of a legal lending contract on the basis of jurisdiction. Borrowers from almost anywhere will be able to use our platform to attain a loan in cryptocurrency or fiat Build a credit score, using our GET tokens as a collateral.

We use Ethereum Smart Contracts to handle the loan process. Get and build up your credit score. Gain a legal identity. Become a supporter Join our network, browse loan requests and profiles or borrowers, as well as the past accuracy metascore of the Attestor of Risk Assessment who has verified particular bitcoin loan website requestand bid bitcoin loan website the lowest interest rate.

Invest in loans you comfortable with. Benefits of GetLine over BitBond include: Subscribe our newsletter Be the first who will know about all news and updates.

Loans are an important part of our society, they allow to grow your money by helping other people to overcome their temporal financial needs. The former are riskier but the received interest rates are higher, which does not mean that margin loans are as safe as fixed deposits nor that they are an inferior choice. Deciding the type of loan that better fits your profile, or even if lending is for you, is a decision you must take carefully; here we will explain the basics to get you started.

Loan sites are fairly common on the fiat world, with the most popular ones closed for new investors due to high demand. Bitcoin lending sites are essentially the same, a centralized platform that connects borrowers and lenders, but marked differences in the way they operate exist. P2P loans are negotiated in an open marketplace, where borrowers post their requests for lenders bitcoin loan website evaluate and invest if they are convinced that it is a solid proposal. The first big difference between fiat and bitcoin lending sites is the absence of credit scores, that is both positive and negative for the involved parties.

Many people is left out of the credit market for not having a credit score, but the lack of it also makes the decision of whom to lend harder bitcoin loan website lenders and still difficult for unbanked individuals to borrow money. Identity verification is often mandatory, in an attempt to avoid fraud and theft.

Submitting a national ID, confirming a valid phone number, going through video verification, linking social accounts and importing bitcoin loan website from other trading or bitcoin loan website websites are among the procedures employed to identify a customer. Given the greater uncertainty interest rates are usually higher than that of banks, representing a good option for investors, but at the same time lower than what local lenders charge, translating into a technical win — win for everybody involved.

Depending on the site additional options are available, including the possibility to add a collateral, get bitcoin loan website loan filled by multiple investors, auto invest and diversify loans, pay or receive early payments and peg amounts to other currencies like USD.

Besides higher returns, investors have in Bitcoin lending a great opportunity to diversify their investments. These loans are borderless and you can spread your money all over the world in small or not-so-small chunks; in fact, doing so is bitcoin loan website encouraged. Commissions in Bitcoin lending platforms are usually smaller than in their fiat counterparts, and given the nature of cryptocurrencies you also save in deposit and withdrawal fees.

Requisites are less and processing times faster, overcoming the long waiting periods, a big issue with traditional banking and their bureaucracy. The volatility of cryptocurrencies also offers an interesting opportunity for borrowers and lenders alike: The most obvious risk are defaults, not having access to credit scores and the lack of instruments to enforce the contracted obligations makes things easier for scammers to run away.

Reputation systems exist but they can and have been cheated, being extra cautious is mandatory if you are going to put your Bitcoin in P2P lending. Debts can still be repaid and funds withdrawn, but, am I the only one that believes a bunch of defaults are bitcoin loan website their way? But borrowers also face their own problems: Avoiding defaulting could lead a borrower to take another loan, translating into an enormous cost. When a trader spots what he believes is a great potential to get profit, he can borrow some money to invest more than what he currently has.

The amount a person can request depends on the funds he holds at the moment and the leverage that the broker or exchange allows. Basically, bitcoin loan website account balance of a trader must be all the time over the borrowed amount plus any interests due, if that level is broken any open positions will be liquidated and the lenders will receive their money with profits back. The only platform where lenders can actively put their money into a margin trading lending fund is Bitfinex.

Users are free to set any amount they want and own of coins for lending, configuring the period and expected interest rate decision which can be left to the platform, under the flashing return rate. When a bitcoin loan website decides to use its leverage, open lending positions are automatically matched, serving first those asking for less in return.

You can get anything from 0. Margin trading lending is not only available for Bitcoin, but also USD and nine altcoins: The average rates for margin funding are available in the statistics page on the Bitfinex website.

This kind of loans also enables shorter terms, they can bitcoin loan website issued for just a few days instead of the weeks or months required by lending bitcoin loan website.

Interest rates also fluctuate with the market, giving the investor the possibility of obtaining better rates either by funding short-term loans or freezing his money in a longer one at a fixed rate. Margin call most of the times work as expected, but sometimes a bitcoin loan website market variation against the trader-borrower takes more than expected from his balance with the loss being passed to the lender.

Bitfinex has also being hacked in the past, in an episode that strongly impacted the Bitcoin price. They have probably doubled their security measures since the incident, but what already happened could happen again and you have to remember the investing maxim: Bitcoin lending, whether it is peer-to-peer or for margin trading, is a risky investment option, where defaults, volatility and other risks are the order of the day.

But risk is an inherent part to investing, and if your nerves can afford dealing with it, Bitcoin lending offers an excellent opportunity to profit, and a market that is still novel and at your disposition. If you follow common sense and put time into carefully choosing where to lend your money, the chances are that you will earn big and fully enjoy the benefits of investing! BitcoinP2PLoans — What is it and how does it work?

Bitcoin Peer-to-Peer Lending Sites Loan sites are fairly common on the fiat world, with the most bitcoin loan website ones closed for new investors bitcoin loan website to high demand. Browsing the loan list on BitBond, one of the established P2P Bitcoin lending sites The first big difference between fiat and bitcoin lending sites is the absence of credit scores, that is both positive and negative for the involved parties.

What are the benefits of BitcoinP2PLoans? What are the risks? Sadly nothing is perfect, and from time to time unwanted consequences arise from this activity. How does it work? What are the benefits? Conclusion Bitcoin loan website lending, bitcoin loan website it is peer-to-peer or for margin trading, is a risky investment option, where defaults, volatility and bitcoin loan website risks are the order of the day.

Braving Ruin 's channel: It's very rare that a leftist and an alt righter sit down and discuss their differences, and even (shock) some agreements. Production of the Q7 began in autumn of at the Volkswagen Bratislava Plant in Bratislava, Slovakia.

The sites DashNearby and Dashous offer a platform for users to connect and meet to trade, bitcoin loan website neither has much bitcoin loan website at the moment. Thanks.