Bitcoin arbitrage opportunities is it really profitable

Margin trading is borrowing money to create positions on an exchange. This increases your profits and your losses because you only have to have a portion of the money you are trading with deposited as a security. You can also do long and short positions. Long positions profit from a price increase in the underlying asset, short positions profit from a price decrease in the underlying asset.

The downside is, that you have to pay interest on the borrowed money for the time your position is open. As soon as there is an arbitrage opportunity, you long on the cheaper exchange and short on the expensive exchange. If the exchange rate on the cheaper one increases to the higher price, you profit on your long position, if the higher rate adapts to the cheaper market your short position is profitable. Whatever happens, you always make money, right? The only way to lose money in this constellation is, if the price difference doesn't close fast enough.

If you are paying interest faster than the arbitrage is closing, you are, again, losing money. As long as you can close your positions before 14 days 0. Your positions close after 5 days, you have made 0. Well, actually only half of that because you only had half of your money on the profitable side.

Usually, there are no such huge differences on reputable markets. And if there are, many traders are buying into them and the margin interest rates increase accordingly. You kind of have to balance the arbitrage opportunity with the current interest rate and that is that what we don't want: Example of changing interest rates on Bitfinex and Poloniex: I can't give you a definite advise here because it is a very complex topic.

There are bots out there helping you to get those trades perfect, especially for the second type but they aren't risk free either. With a growing number of professional traders in the system, it gets harder and harder for the individual to game the system.

What I can recommend is getting on the other side of things: Funding is lending money to other traders to trade with. Drop a like if you want me to review different kinds of funding on different platforms for you. Here is a small present to show our gratitude You can click on your award to jump to your Board of Honor. I wrote an article that explains the math involved in a simple way to arbitrage across cryptocurrency exchanges.

Important to know what you are getting into so that you will not be trading at a loss. EtherDelta is a Goldmine, insane arbitrage opportunity https: Is it Really Profitable?

Where used, we will disclose this and make no attempt to hide it. We don't endorse any affiliate services we use - and will not be liable for any damage, expense or other loss you may suffer from using any of these. Don't rush into anything, do your own research. As we write new content, we will update this disclaimer to encompass it. We first discovered Bitcoin in late , and wanted to get everyone around us involved.

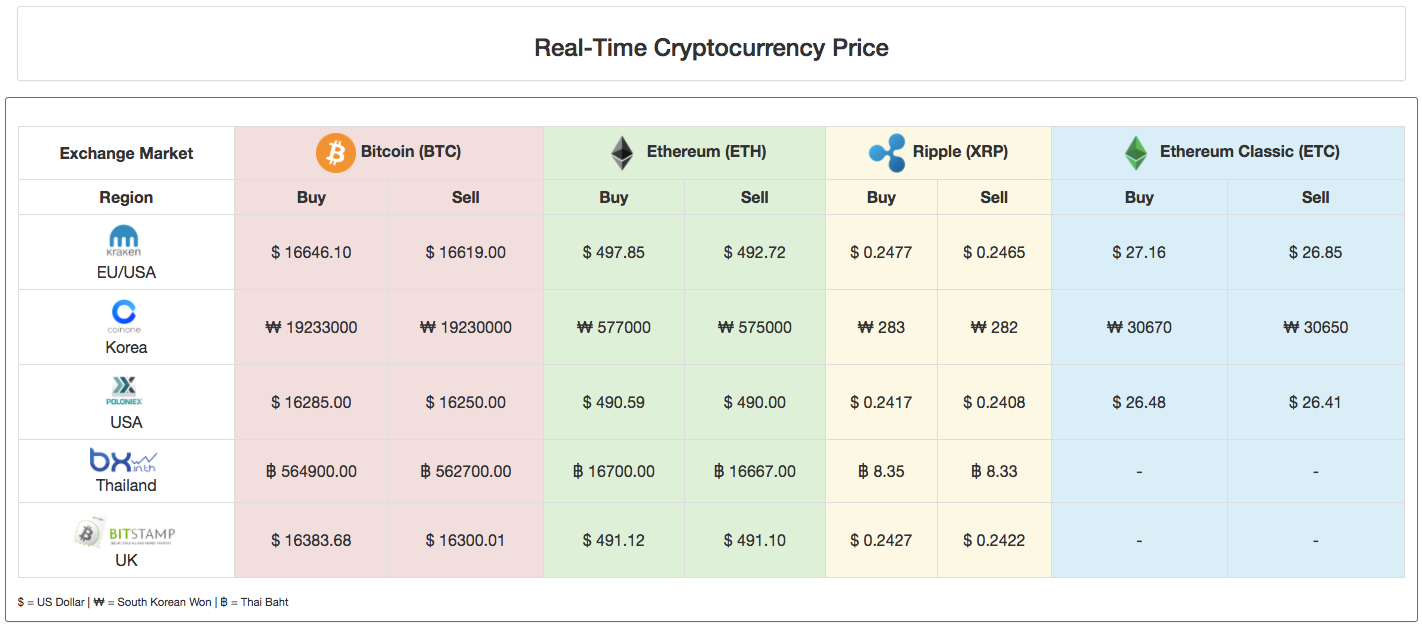

But no one seemed to know what it was! We made this website to try and fix this, to get everyone up-to-speed! Click here for more information on these. All information on this website is for general informational purposes only, it is not intended to provide legal or financial advice. How to Trade with Bitcoin Arbitrage. There are several ways to do arbitrage trading on Bitcoin: Buy Bitcoin on an exchange, transfer it to another exchange and sell it, then transfer it back to the original exchange and repeat.

How to find Bitcoin Arbitrage opportunities? But once you know where arbitrage opportunities are, you need to be aware of a number of things: Be especially careful of fees when moving crypto between exchanges; these fees are often fixed, where you have to transfer large amounts for trades to be profitable. Fiat in particular can take days if not weeks to withdraw. Sometimes this can be very extreme where small exchanges have completely seperate economies for smaller coins than larger exchanges.

Both the extra load from traders like yourself and DDoS attacks can lead to problems selling and withdrawing. If you plan to create a bot for arbitrage trading, test APIs beforehand. Until a recent upgrade, Kraken for example has had bad API performance, so arbitrage trading via it would have been very difficult if not impossible.

Be aware that you may have to declare each trade when submitting your taxes especially if you're doing it with large amounts or very frequently. We're working on a Crypto Coin Tracker to help with this issue.

Best Bitcoin Arbitrage Bots?