Bitcoin and ethereum price correlation

Although bitcoin and ethereum price correlation is some merit to the hypothesis of crypto-coins not correlating with traditional assets, if crypto-coin prices remain elevated or increase further and become a significant part of the global financial system, higher correlation with traditional assets may become inevitable. Scientifically speaking therefore, this article is speculative. Great workgood job! Thanks rl90hope its worthy of an upvote .

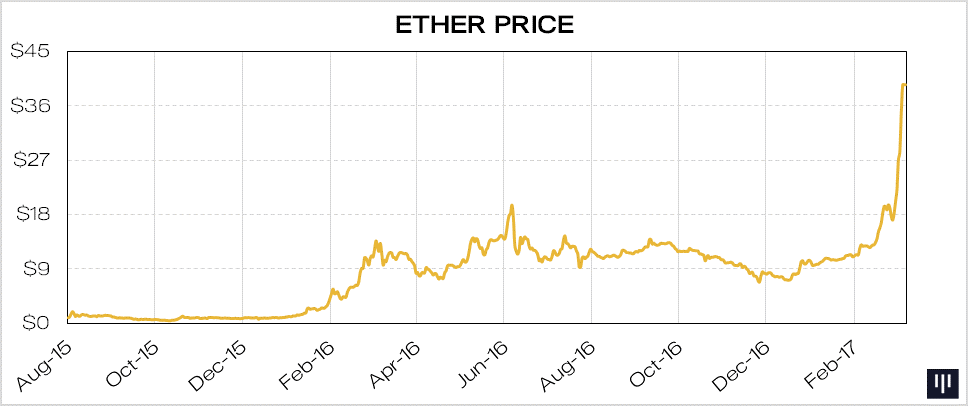

During the recent rally to a valuation of hundreds of billions of dollars, however, correlations — and, crucially, correlations to risk-on assets — started to increase. Thankyou daydreams4rocki'll try to post a lot more about cryptos! As the chart below demonstrates, the correlation never really significantly escaped the I guess it should! Yeah makes sense, maybe the fact that bitcoin and ethereum price correlation will decrease the value of the original coins is why stellar is giving out the free tokens to existing hodlers anyways.

Overview We calculated the day rolling daily percentage price-change correlation between Bitcoin and a variety of traditional financial assets since bitcoin and ethereum price correlation Therefore its price correlation with Bitcoin started low before eventually reaching levels similar to Litecoin. I heard something about this news pedrombraz! Due to the current correlation with stocks, Bitcoin may no longer offer downside protection in the event of a financial crisis, which some people may expect.

Is there a time delay component to the correlation? We look at the price correlation between Bitcoin and some traditional financial assets since and notice that the correlation with stocks in the last bitcoin and ethereum price correlation months has reached record high levels, although it remains reasonably low in absolute terms. You know what I mean? Thanks rl90hope its worthy of an upvote. The correlation closer to 1 mean that prices behave similar The correlation closer to -1 means an inverse relationship, i.

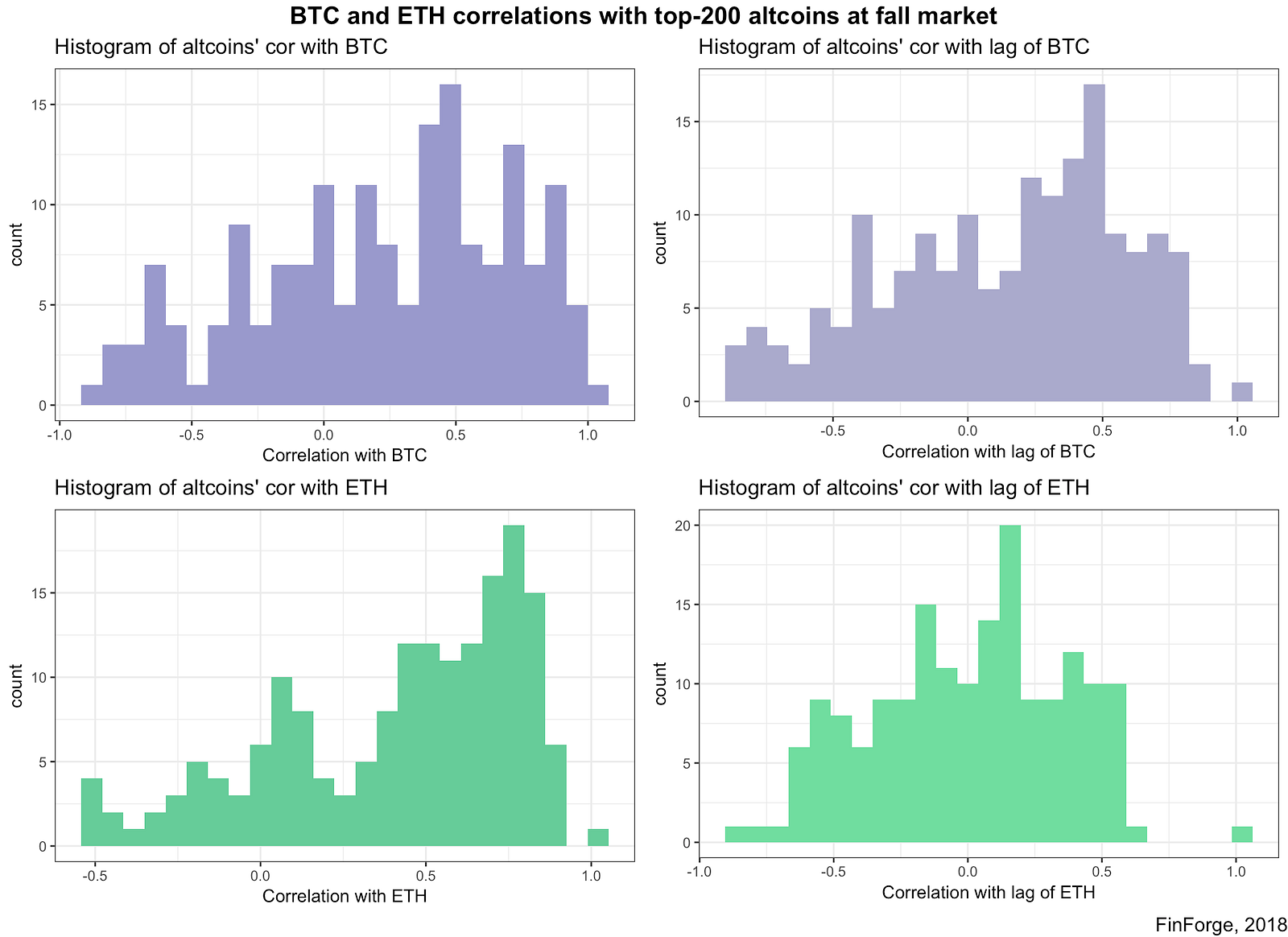

During the recent rally to a valuation of hundreds of billions of dollars, however, correlations — and, crucially, correlations to risk-on assets — started to increase. The R-squared between Bitcoin and other assets in the chart below is low, peaking at only 6. Litecoin — The correlation normally tends to be high, at around the 0. These traditional portfolio managers are then expected to allocate a weighting in their portfolios for crypto-coins, which may cause further price appreciation. The picture below bitcoin and ethereum price correlation the correlations between BTC and Altcoins which was updated today.

In addition to this, we have not been able to prove the statistical significance of any daily price-change correlation between Bitcoin and any traditional asset using any robust methodology. Bitcoin price correlation versus various traditional assets — daily price percentage change over a rolling day period. This bitcoin and ethereum price correlation useful for those investors who want to see the relationship between all cryptocurrencies, and how they perform relative to the movement of the market. We calculated the day rolling daily percentage price-change correlation between Bitcoin and a variety of traditional financial assets since Authors get paid when people like bitcoin and ethereum price correlation upvote their post.