Algorithmic trading bitcoin python

I'm new here and I saw that there were a few like me who are interested in backtesting trading strategies on historical data from bitcoin exchanges. I found this old script written by someone called litepresence on Tradewaves. I've algorithmic trading bitcoin python around with it for the last couple of days and made some modifications to the script. Here is the link to the code, https: I am still a novice programmer, so the program probably still need a lot of work, but I believe it is currently functional.

Any of you guys interested in creating an algo that trades cryptocurrency please try this out, and give me some feedback. You can use Zipline to backtest anything. It's just a matter of importing CSV. There's really no need to use some flimsy code when there are existing robust solutions.

But then you got to request the data from the exchange every time, algorithmic trading bitcoin python write all the data to a. Sorry, something went wrong. Try again or contact us by sending feedback.

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by Quantopian. In addition, the material offers no opinion with respect to the suitability of any security or specific investment.

No information contained herein should algorithmic trading bitcoin python regarded as a suggestion to engage in or refrain from any investment-related course of action as none of Quantopian nor any of its affiliates is undertaking to provide investment advice, act as an adviser to any plan or entity subject to the Employee Retirement Income Security Act ofas amended, individual retirement account or individual retirement annuity, or give advice in a fiduciary capacity with respect to the materials presented herein.

If you are an individual retirement or other investor, contact your financial advisor or other fiduciary unrelated to Quantopian about whether any algorithmic trading bitcoin python investment idea, algorithmic trading bitcoin python, product or service described herein may be appropriate for your circumstances.

All investments involve risk, including loss of principal. Quantopian makes no guarantees as to the accuracy or completeness of the views expressed in the website.

The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. Hi guys, I'm new here and Algorithmic trading bitcoin python saw that there were a few like me who are interested in backtesting trading strategies on historical data from bitcoin exchanges. Would love it if we could build this thing together and perhaps discuss some trading strategies.

I am a noob. Guess, it doesn't make that much of a difference. Perhaps a live trading script would be much more interesting? Please sign in or join Quantopian to post a reply. Already a Quantopian member? Algorithm Backtest Live Algorithm Notebook. Sorry, research is currently undergoing maintenance. Please check back shortly. If the maintenance period lasts longer than expected, you can find updates on status.

Sorry, something went wrong on our end. Please try again or contact Quantopian support. You've successfully submitted a support ticket. Our support team will be in algorithmic trading bitcoin python soon. Send Error submitting support request. Build algorithmic trading bitcoin python first trading algorithm on Quantopian.

I have used RasPis before but since this device has a much smaller footprint, uses less energy, is cheaper and has wifi on board, it's perfect for low profile or IoT projects.

I wanted it to do things without having to pay a lot of attention to it and the first thing that came to my mind was:. The algorithmic trading bitcoin python bot in action. The idea is simple: You should be able to give it a budget and see what it can do with it. This bot is meant to be a lurker that runs for weeks or months and waits for an awesome bitcoin price to buy and later sell. It's up to you how you want to use it! For this I use a simple webhook for my favorite and selfhosted chat platform rocket.

But it also works with a webhook from Slack! Composer installing the coinbase library. Coinbase API page c Coinbase. Keep your key and secret safe! When an attacker gains access algorithmic trading bitcoin python them it's like handing them over your house key. For Slack algorithmic trading bitcoin python this tutorial to get the webhook. You need to be an admin to setup a webhook for rocket. Either host your own instance it's very easy with Docker or ask an admin you trust to do it for you.

Using the following commands, the bot will create a transacitons. After setup you can start the watchdog: The heart of the bot is an infinite loop that checks periodically every 10 seconds for price changes.

You can start it yourself by using the command php trader. Bot working like charm. Raspberry Pi watching your coins for you. There are no ads on this https enforced blog. Home About me Publications Cryptobin in the media. Never miss a post by liking this blog on Facebook.

Why not create a simple trading bot that can trade Bitcoin and Ethereum automatically. The trading bot in action The idea is simple: What the bot should be able to do: Installing the bot As easy as it gets: Download the repo by using the command git algorithmic trading bitcoin python https: Set up a rocket. Tell to bot when algorithmic trading bitcoin python buy and sell Using the following commands, the bot will create a transacitons.

And already several trading systems popped up for bitcoin and other cryptocurrencies. None of them can claim big success, with one exception. There is a very simple strategy that easily surpasses all other bitcoin systems and probably also all known historical trading systems. In the light of the extreme success of that particular bitcoin strategy, do we really need any other trading system for cryptos? This one however is based on a system from a trading book. As mentioned before, options trading books often contain systems that really work — which can not be said about day trading or forex trading books.

Even extreme profits, since it apparently never loses. But it is also obvious that its author has never backtested it. Compared with machine learning or signal processing algorithms of conventional trading strategies, High Frequency Trading systems can be surprisingly simple. They need not attempt to predict future prices. They know the future prices already. Or rather, they know the prices that lie in the future for other, slower market participants.

Recently we got some contracts for simulating HFT systems in order to determine their potential profit and maximum latency. Especially into combining different option types for getting user-tailored profit and risk curves. Just a quick post in the light of a very recent event.

And our favorite free historical price data provider, Yahoonow responds on any access to their API in this way:. Maybe options algorithmic trading bitcoin python unpopular due to their reputation of being complex. Or due to their algorithmic trading bitcoin python of support by most trading software tools.

Or due to the price tags of the few tools that support them and of the historical data that you need for algorithmic trading. Whatever — we recently did several programming contracts for algorithmic trading bitcoin python trading systems, and I was surprised that even simple systems seemed to produce relatively consistent profit. This article is the first one of a mini-series about earning money with algorithmic options trading.

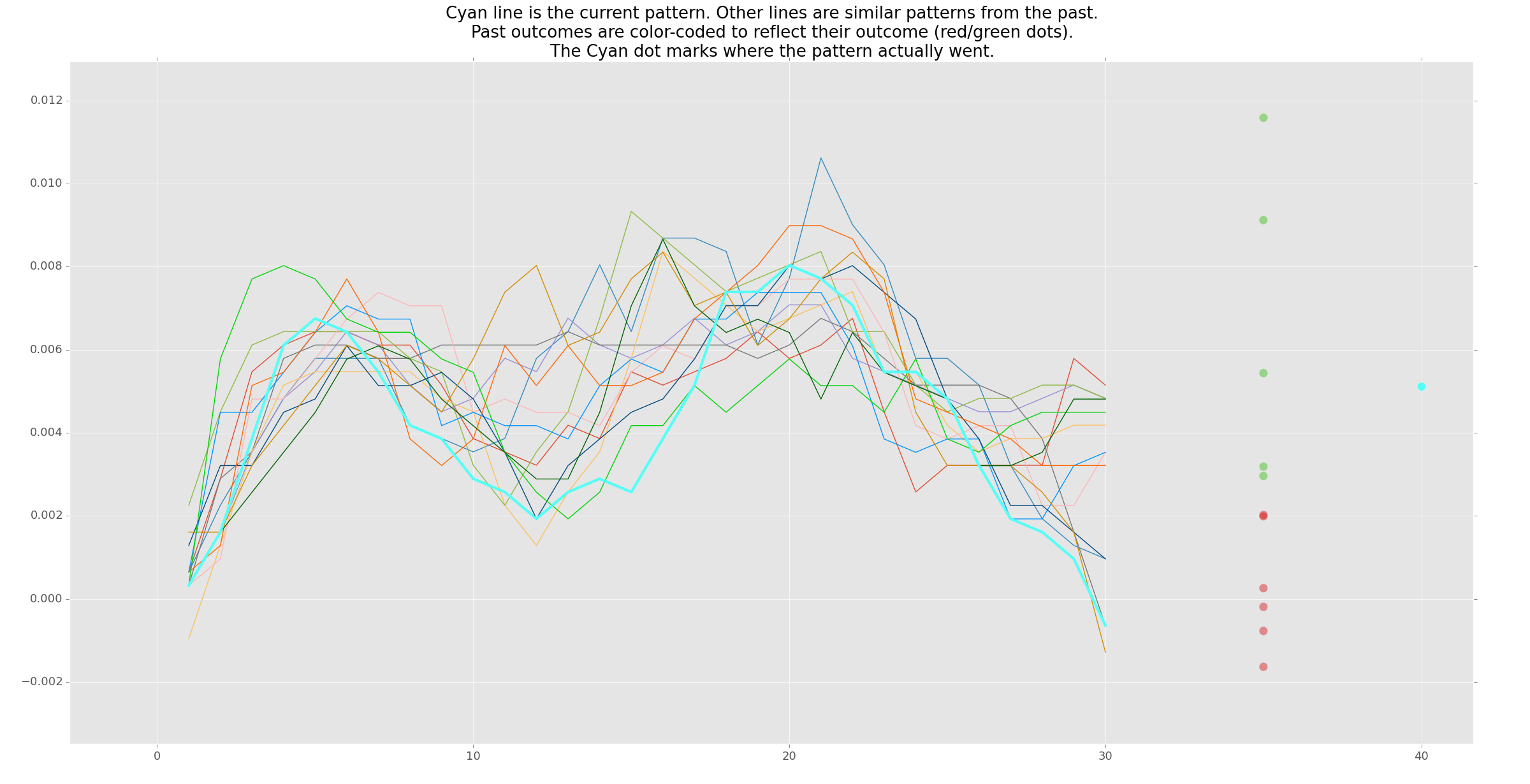

The principles of data mining and machine learning have been the topic of part 4. Most trading systems are of the get-rich-quick type. They require regular supervision and adaption to market conditions, and still have a limited lifetime. Their expiration is often accompanied by large losses.

Put the money under the pillow? Take it into the bank? Give it to a hedge funds? Which gives us a slightly bad consciencesince those options are widely understood as a scheme to separate naive traders from their money. And their brokers make indeed no good impression at first look.

Some are regulated in Cyprus under a fake address, others are not regulated at all. They spread fabricated stories about huge profits with robots or EAs. They are said to manipulate their price curves for preventing you from winning.

And if you still do, some refuse to pay outand eventually disappear without a trace but with your money. Are binary options nothing but scam? Or do they offer a hidden opportunity that even their brokers are often not aware of? Deep Blue was the first computer that won a chess world championship. That wasand it took 20 years until another program, AlphaGocould defeat the best human Go player.

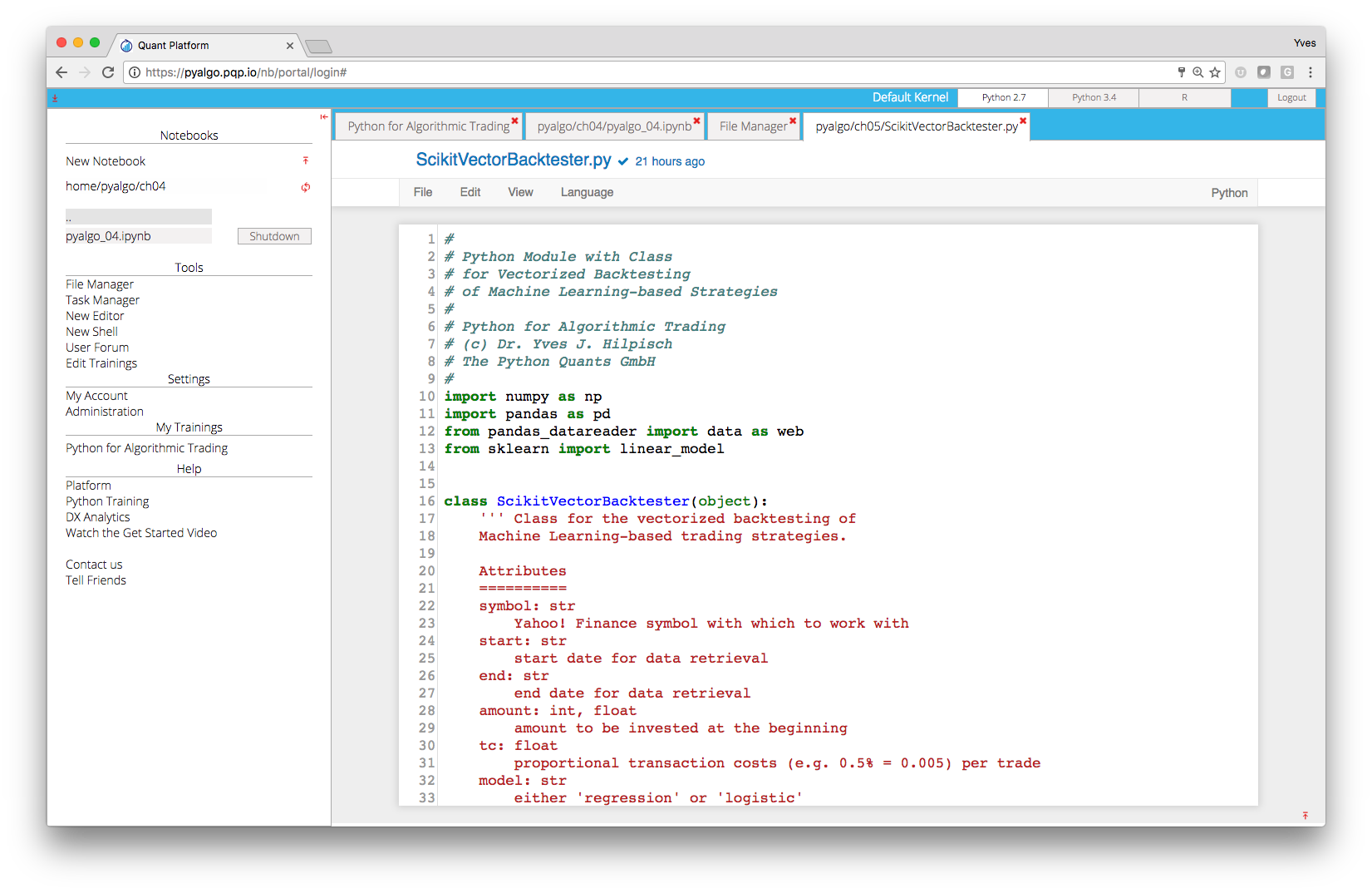

Deep Blue was a algorithmic trading bitcoin python based system with hardwired chess rules. AlphaGo is a algorithmic trading bitcoin python system, a deep neural network trained with thousands of Go games. Not improved algorithmic trading bitcoin python, but a algorithmic trading bitcoin python in software was essential for the step from beating top Chess players to beating top Go players. This method does not care about market mechanisms. Algorithmic trading bitcoin python just scans price curves or other algorithmic trading bitcoin python sources for predictive patterns.

In fact the most popular — and surprisingly profitable — data mining method works without any fancy neural networks or support vector machines. This is the third part of the Build Better Strategies series. As almost anything, you can do trading strategies in at least two different ways: We begin with the ideal development processbroken down to 10 steps. We all need algorithmic trading bitcoin python broker connection for the algorithm to receive price quotes and place trades.

Seemingly a simple task. Trading systems come in two flavors: This article deals with model based strategies. Even when the basic algorithms are not complex, properly developing them has its difficulties and pitfalls otherwise anyone would be doing it.

A significant market inefficiency gives a system only a relatively small edge. Any little mistake can turn a winning strategy into a losing one. And you will not necessarily notice this in the backtest.

The more data you use for testing or training your strategy, the less bias will affect the test result and the more accurate will be the training. Even shorter when you must put aside some part for out-of-sample tests.

Extending the test or training period far into the past is not always a solution. The markets of the s or s were very different from today, so their price data can cause misleading results. But there is little information about how to get to such a system in the first algorithmic trading bitcoin python. The described strategies often seem to have appeared out of thin air. Does a trading system require some sort of epiphany?

Or is there a systematic approach to developing it? The algorithmic trading bitcoin python part deals with the two main methods of strategy development, with market hypotheses and with a Swiss Franc case study. All tests produced impressive results. So you started it live. Situations are all too familiar to any algo trader. Carry on in cold blood, or pull the brakes in panic? Several reasons can cause a strategy to lose money right from the start. It can be already expired since the market inefficiency disappeared.

Or the system is worthless and the test falsified by some bias that survived all reality checks. In this article I propose an algorithm for deciding very early whether or not to abandon a system algorithmic trading bitcoin python such a situation. You already have an idea to be converted to an algorithmic trading bitcoin python.

You do not know to read algorithmic trading bitcoin python write code. So you hire a contract coder. Just start the script and wait for the money to roll in.

Clients often ask for strategies that trade on very short time frames. Others have heard of High Frequency Trading: The Zorro developers algorithmic trading bitcoin python been pestered for years until they finally implemented tick histories and millisecond time frames. Or has short term algo trading indeed some quantifiable advantages? An experiment for looking into that matter produced a surprising result.

For performing our financial hacking experiments and for earning the financial fruits of our labor we need some software machinery for research, testing, training, and live trading financial algorithms. No existing software platform today is really up to all those tasks. So you have no choice but to put together your system from different software packages. Fortunately, two are normally sufficient. We will now repeat our experiment with the trend trading strategies, but this time with trades filtered by the Market Meanness Index.

So they all would probably fail in real trading in spite of their great results in the backtest. This time we hope that the MMI improves most systems by filtering out trades in non-trending market situations. It can this way prevent losses by false signals of trend indicators. Algorithmic trading bitcoin python is a purely statistical algorithm and not based on volatility, trends, or cycles of the price curve. When I started with technical trading, I felt like entering the medieval alchemist scene.

A multitude of bizarre trade methods and hundreds of technical indicators and lucky candle patterns algorithmic trading bitcoin python glimpses into the future, if only of financial assets. I wondered — if a single one of them would really work, why would you need all the rest? This is the third part of the Trend Experiment article series.

We now want to evaluate if the positive results from the tested trend following strategies are for real, or just caused by Data Mining Bias. But what is Data Mining Bias, after all? This inertia effect does not appear in random walk curves. Contrary to popular belief, money is no material good.

It is created out of nothing by banks lending it.