1 bitcoin to audit

Later, he became intrigued by the concept for a Bitcoin regulatory software company. The value arises solely from that placed by users. Sorry, your blog cannot share posts by email.

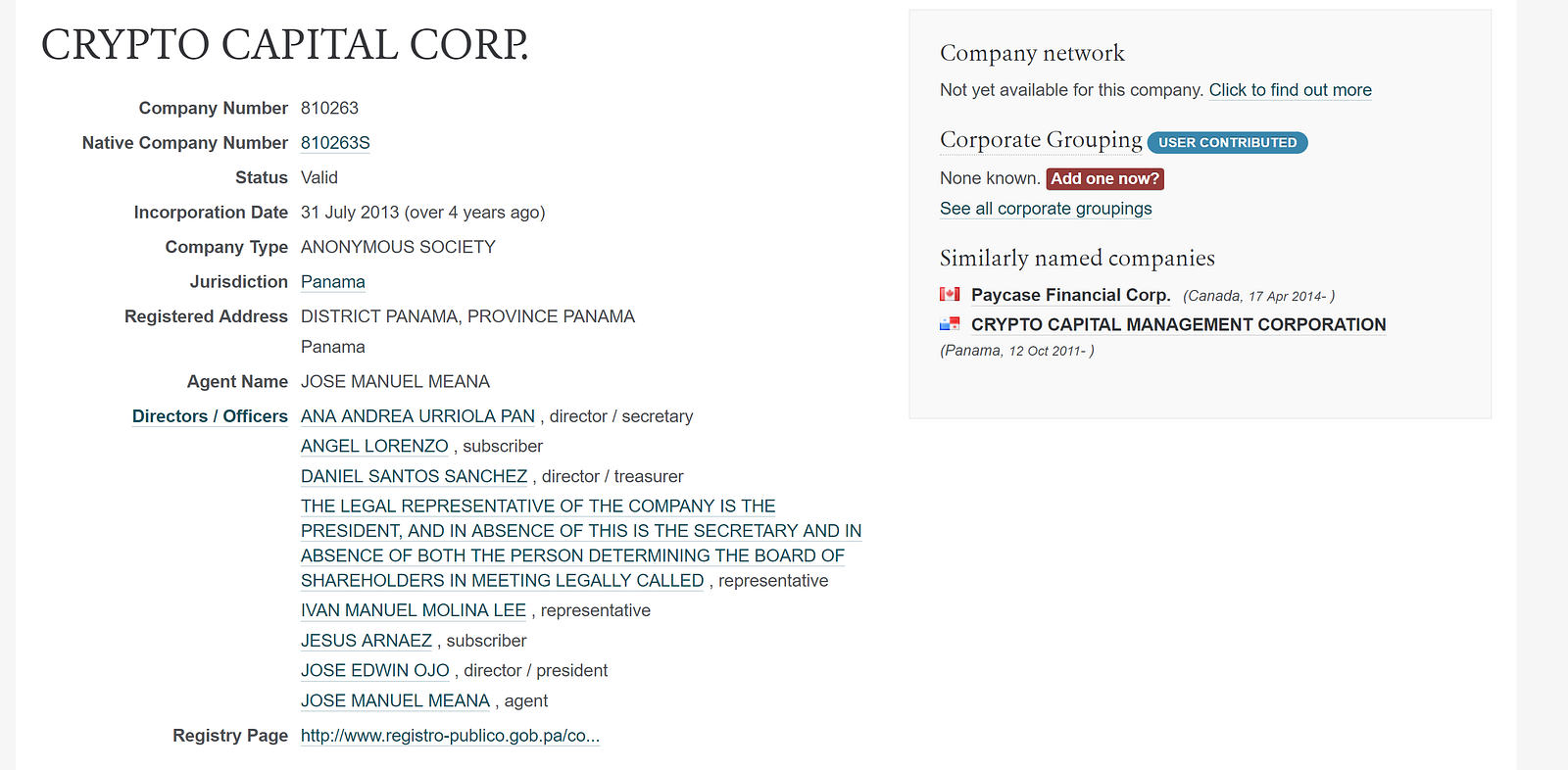

How is it used? Specifically, the Commission has expressed concerns that "the rising use of virtual 1 bitcoin to audit in the global marketplace may entice fraudsters to lure investors into Ponzi and other schemes in which these currencies are used to facilitate fraudulent, or simply fabricated, investments or transactions. To learn more about Verady, visit its website and follow it on Twitter. Department of Justice have brought actions against individuals and 1 bitcoin to audit for allegedly creating an unlicensed broker-dealer and setting up a "purported Bitcoin" platform.

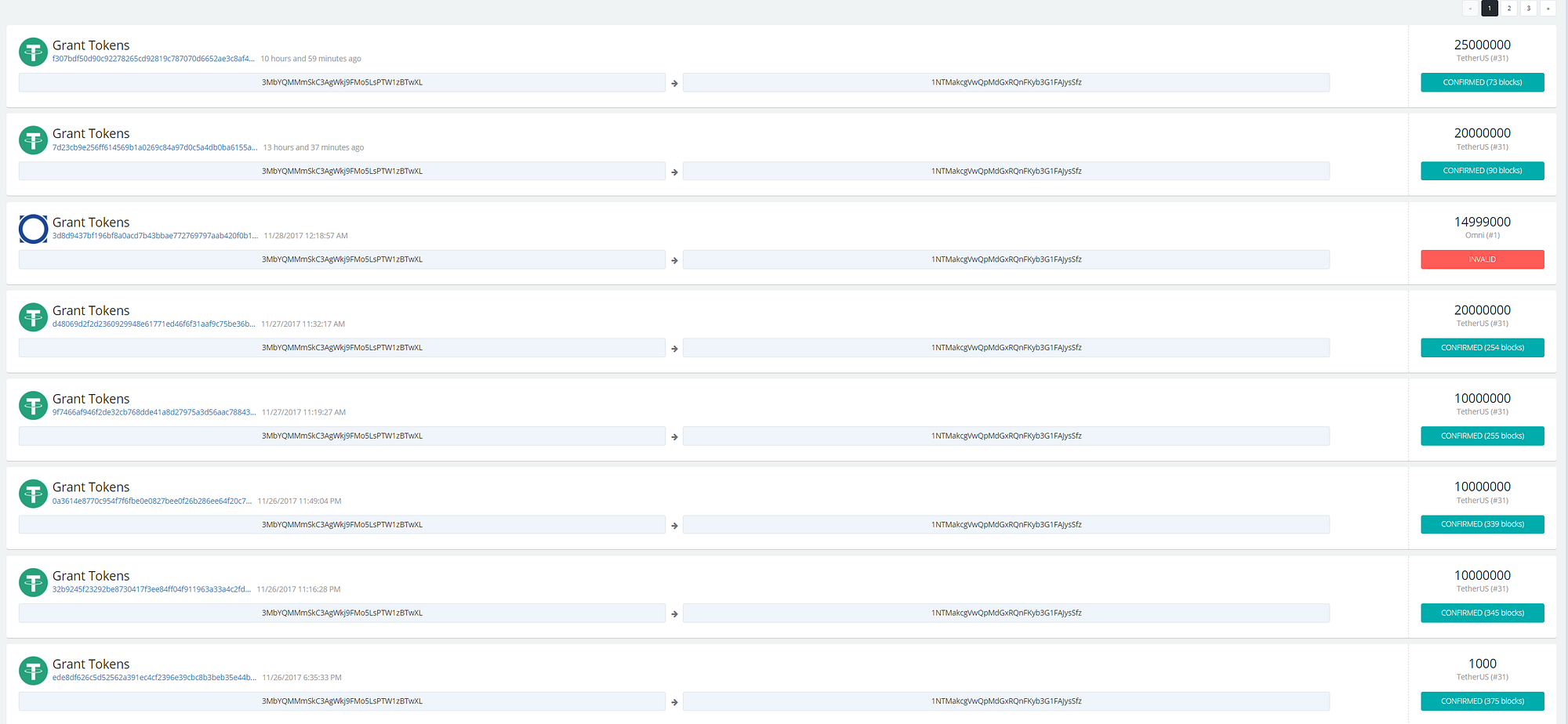

Completeness and cutoff are the other side to 1 bitcoin to audit since this information is kept on the blockchain all a person needs is the address and 1 bitcoin to audit full transaction history can be found. First, let's establish what these digital currencies, also called cryptocurrencies or virtual currencies, are. If you have been active in bitcoin for any length of time, then you have likely either lost money in an exchange failure or you know someone who has. This led to the founding of Coinpliance in

Cryptocurrencies are created, and transactions validated, through the 1 bitcoin to audit of complex mathematical equations, known as cryptographic hashes, by users with special software. Comments Really good article on a practical approach! A material discrepancy is an amount that could call into question the accuracy of the solvency assertion. Secretary of State for Discussion on U.

SEC, BitLicense or other regulatory filings, stakeholder information requirements, etc. Combined with blockchain-based identity, the enablement of credit underwriting based on cryptocurrencies could greatly aid in financial inclusion, particularly for many living in underdeveloped countries across the globe. Their combination of common backgrounds with differing experience levels and perspectives have led to a unique profile for the company. Finally, the fact that the code itself is controlled by the client may raise internal control risk to the point that the auditor is unable to use it for testing.